2019-04-15 08:37:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Chinese Belt-and-Road funds large international infrastructure investment projects primarily in East Asia, Central Asia, North Africa, and Italy. Chinese Belt-and-Road aims to strengthen infrastructure, trade, transport, and investment links between China and 65 other countries that collectively account for more than 30% of global GDP, 62% of world population, and 75% of international energy. In fact, East Asia, Pacific Basin, Central Asia, and some parts of Europe account for almost 80% of total exports from Belt-and-Road economies, and these Belt-and-Road economies account for 37%-43% of world exports and intermediate goods as of early-2019.

Belt-and-Road economies exhibit substantive integration into global value chains as China plays a more central role in this cross-border trade integration. In recent years, the main economic engine of Belt-and-Road exports has been the global demand for key consumer electronic appliances from iPhones and iPads to tablets, laptops, and other robotic products.

However, U.S. State Department continues to raise grave concerns about opaque financial practices, subpar governance standards, and less inclusive social norms and principles in the Chinese Belt-and-Road program. America remains a staunch opponent of this trans-continental infrastructure scheme. This scheme serves as a new investment vehicle for China to spread its core financial prowess and influence overseas.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-27 09:35:00 Monday ET

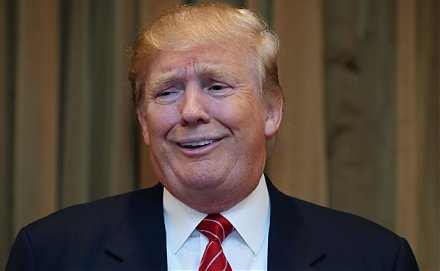

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2019-02-15 11:33:00 Friday ET

President Trump is open to extending the March 2019 deadline for raising tariffs on Chinese imports if both sides are close to mutual agreement. These bilat

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an

2023-06-21 12:32:00 Wednesday ET

Michael Sandel analyzes what money cannot buy in stark contrast to the free market ideology of capitalism. Michael Sandel (2013) What money

2018-11-23 09:39:00 Friday ET

Former White House chief economic advisor Gary Cohn points out that there is no instant cure for the Sino-U.S. trade dilemma. After the U.S. midterm electio