2019-04-15 08:37:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Chinese Belt-and-Road funds large international infrastructure investment projects primarily in East Asia, Central Asia, North Africa, and Italy. Chinese Belt-and-Road aims to strengthen infrastructure, trade, transport, and investment links between China and 65 other countries that collectively account for more than 30% of global GDP, 62% of world population, and 75% of international energy. In fact, East Asia, Pacific Basin, Central Asia, and some parts of Europe account for almost 80% of total exports from Belt-and-Road economies, and these Belt-and-Road economies account for 37%-43% of world exports and intermediate goods as of early-2019.

Belt-and-Road economies exhibit substantive integration into global value chains as China plays a more central role in this cross-border trade integration. In recent years, the main economic engine of Belt-and-Road exports has been the global demand for key consumer electronic appliances from iPhones and iPads to tablets, laptops, and other robotic products.

However, U.S. State Department continues to raise grave concerns about opaque financial practices, subpar governance standards, and less inclusive social norms and principles in the Chinese Belt-and-Road program. America remains a staunch opponent of this trans-continental infrastructure scheme. This scheme serves as a new investment vehicle for China to spread its core financial prowess and influence overseas.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-24 14:38:00 Saturday ET

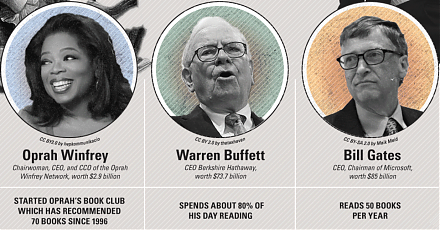

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2023-03-14 16:43:00 Tuesday ET

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes. Thomas Pogge and Krishen

2018-10-11 08:44:00 Thursday ET

Treasury bond yield curve inversion often signals the next economic recession in America. In fact, U.S. bond yield curve inversion correctly predicts the da

2020-02-02 10:31:00 Sunday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement

2018-01-02 12:39:00 Tuesday ET

Goldman Sachs takes a $5 billion net income hit that results from its offshore cash repatriation under the new Trump tax law. This income hit reflects 10%-1

2018-12-15 14:38:00 Saturday ET

Google CEO Sundar Pichai makes his debut testimony before Congress. The post-mid-term-election House Judiciary Committee bombards Pichai with key questions