2022-09-15 11:38:00 Thu ET

corporate finance capital structure trade-off theory pecking order theory target leverage adjustment speed market-to-book ratio fama and french graham and harvey market timing theory baker and wurgler flannery and rangan huang and ritter

The Kauffman Firm Survey (KFS) database provides comprehensive panel data on 5,000+ American private firms from 2004 to the present. The U.S. Federal Reserve Board's Survey of Small Business Finance (SSBF) provides cross-sectional data on about 2,000+ American private firms in 1987, 1993, 1998, and 2003. Robb and Robinson (RFS 2012) study the capital structure choices that about 5,000+ KFS private firms make in their initial years of business operations. The sample startups rely heavily on external debt sources such as bank finance and less extensively on angel finance from families and friends. This reliance on external debt underscores the importance of credit markets for the success of nascent business activity.

Cole (FM 2013) Frank and Goyal's (FM 2009) study of major determinants of small business capital structure choices. Past studies shine fresh light on the empirical nexus between bank relationships and private firm funds (Petersen and Rajan, JF 1994; Berger and Udell, JB 1995, JBF 1998, EJ 2002). A private firm with no banking relationships has significantly lower leverage, whereas, a private firm with multiple banking relationships has significantly higher leverage. A private firm's primary-owner characteristics affect the firm's capital structure choice (e.g. Ang, Cole, and Lin, JF 2000; Villalonga and Amit, JF 2006). Cole (FM 2013) empirically finds that minority owners tend to use debt finance in a conservative manner relative to the median owner.

Myers (JEP 2001) points out that capital structure theories are not designed to be general for testing them on a broad heterogeneous dataset to yield informative results. Fama and French (RFS 2002, JFE 2005) suggest that both the trade-off and pecking-order theories represent some elements of truth as stable mates in capital structure decisions. The lack of panel data on the leverage ratios of private firms severely restricts the econometrician's ability to deal with the dynamic versions of capital structure theories. This logic spans the studies by Fama and French (RFS 2002), Baker and Wurgler (JF 2002), Welch (JPE 2004), Flannery and Rangan (JFE 2006), Antoniou et al (JFQA 2008), and Huang and Ritter (JFQA 2009). This strand of capital structure literature specifies the dynamic tests and suggests a wide range of target adjustment speed estimates from 3 years to nearly 20 years. Specifically, Huang and Ritter (JFQA 2009) point out that target leverage is highly persistent through time (Lemmon, Roberts, and Zender, JF 2008; DeAngelo and Roll, JF 2015). This persistence requires the use of Hausman et al's (JE 2007) long-differencing panel estimator to address firm-specific unobservable heterogeneity in capital structure choice. This long-differencing panel estimator results in point estimates of partial adjustment toward target leverage of about 5 to 7 years. Huang and Ritter (JFQA 2009) discuss each econometric method in detail (e.g. Fama-MacBeth cross-sectional regressions, mean-differencing panel regressions, dynamic GMM panel regressions, and long-differencing panel regressions).

Because private firms do not list equity issues on major stock exchanges, the econometrician cannot test the market-timing theory for these sample firms. Cole (FM 2013) finds empirical support for pervasive trade-off and pecking-order determinants of capital structure choices by private firms. Cole (FM 2013) reports that American private firms employ a comparable degree of leverage relative to small public firms on Compustat. This latter evidence contradicts Brav's (JF 2009) main thesis that British private firms use much greater leverage there.

The econometrician can estimate the partial adjustment speed by carrying out Fama-MacBeth regressions, mean-differencing and long-differencing panel regressions, and dynamic GMM panel regressions (Fama and French, RFS 2002; Baker and Wurgler, JF 2002; Welch, JPE 2004; Flannery and Rangan, JFE 2006; Antoniou, Guney, and Paudyal, JFQA 2008; Huang and Ritter, JFQA 2009; Petersen, RFS 2009). In each case, the target leverage ratio can be quantified as a linear combination of financial ratios, firm characteristics, and owner attributes. Persistent deviations from target leverage would be detrimental to the private firm's fair value and its ability to raise debt (but not market equity) as the dominant form of financial flexibility (DeAngelo, DeAngelo, and Whited, JFE 2011; McLean, JFE 2011; Denis and McKeon, RFS 2012). Just as the target payout adjustment is faster for private firms (Michaely and Roberts, RFS 2011), the target leverage adjustment should be faster for private firms in favor of primary-owner utility maximization because agency costs are substantially lower at these private firms relative to public firms. The econometrician can carry out some time-series analysis of the secular trend in the typical private firm’s capital structure to ascertain whether this trend is similar to the steep increase in aggregate corporate leverage that significantly correlates with both government leverage and financial-sector output from private business credit and equity issuance (Graham, Leary, and Roberts, JFE 2015).

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2019-03-05 10:40:00 Tuesday ET

We may need to reconsider the new rules of personal finance. First, renting a home can be a smart money move, whereas, buying a home cannot always be a good

2017-09-13 10:35:00 Wednesday ET

CNBC reports the Top 5 features of Apple's iPhone X. This new product release can be the rising tide that lifts all boats in Apple's upstream value

2018-07-23 07:41:00 Monday ET

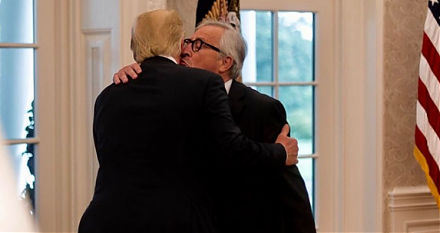

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2019-04-29 08:35:00 Monday ET

IMF chief economist Gita Gopinath predicts no global recession with key downside risks at this delicate moment. First, trade tensions remain one of the key

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan