2019-04-25 09:35:00 Thu ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Bridgewater hedge fund founder Ray Dalio suggests that the current state of U.S. capitalism poses an existential threat for many Americans. Dalio deems the current levels of U.S. economic inequality a national emergency that requires a complete reformation of capitalism in America. The Pareto power law shows that the upper echelon of top 20% income earners accounts for 80% of economic wealth in most U.S. states. The rich can transfer their economic advantages from one generation to the next through elite education, political clout, and family ownership and control of public corporations. This hereditary wealth concentration persists over decades.

Firms need to fill the skill gap in talent retention; workers earn stagnant real wages over years; consumers face fewer choices in terms of products and services; and financial intermediaries encounter a mismatch between savers and profitable stock market investments. It is important for policymakers to help enhance the financial literacy, freedom, and inclusion of the general public. Americans, immigrants, and foreigners can learn more about stock market news and memes, proprietary alpha signals, economic trends, and investment tips on our AYA fintech network platform. These endeavors help abate the existential threat that U.S. capitalism poses for many Americans.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c

2025-10-08 11:34:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-07 12:33:00 Wednesday ET

Conor McGregor learns a major money lesson from LeBron James. This lesson suggests that James spends about $1.5 million on his own body each year. The $1.5

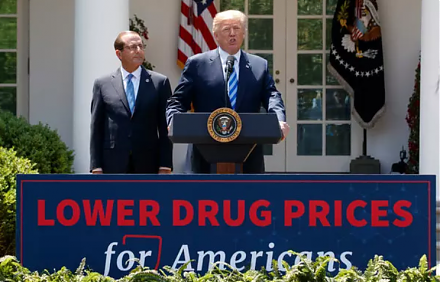

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2019-12-07 11:30:00 Saturday ET

China turns on its 5G telecom networks in the hot pursuit of global tech supremacy. China Telecom, China Unicom, and China Mobile disclose 5G fees of $18-$2