2019-05-23 10:33:00 Thu ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French economist and author Thomas Piketty advocates that there is an innate tendency toward wealth concentration in most market economies where the nominal interest rate on capital investments well exceeds the economic growth rate. Former IMF chief economist Olivier Blanchard argues that the real interest rate on risk-free government bonds must be lower than the economic growth rate for most market economies to carry greater government debt with low inflation. Blanchard focuses on the real interest rate on low-risk government bonds, whereas, Piketty focuses on the nominal return on risky capital investments.

These interest rates diverge by a 5%-6% equity risk premium, which reflects how risk-averse the typical stock market investor is through the real business cycle. For Piketty, high wealth concentration can result from a large equity risk premium that calls for higher taxes on the rich. For Blanchard, the government can accumulate higher public debt as core CPI inflation remains moderate over time. On balance, Eichengreen supports greater fiscal deficit finance for health care, infrastructure, R&D, and social security as prices and asset premiums stabilize in recent times.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

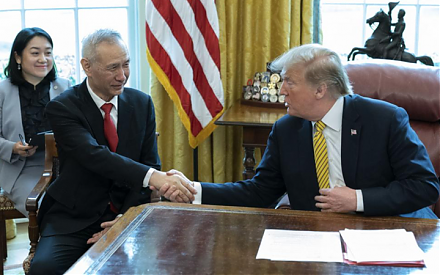

2019-02-15 11:33:00 Friday ET

President Trump is open to extending the March 2019 deadline for raising tariffs on Chinese imports if both sides are close to mutual agreement. These bilat

2023-10-07 10:24:00 Saturday ET

Thomas Philippon draws attention to greater antitrust scrutiny in light of the rise of market power and its economic ripple effects. Thomas Philippon (20

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2019-11-03 12:30:00 Sunday ET

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2018-03-27 07:33:00 Tuesday ET

CNBC's business anchorwoman Becky Quick interviews Nobel Laureate Joseph Stiglitz on the current trade war between America and China. As America imposes

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major