2018-11-21 11:36:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Apple upstream suppliers from Foxconn and Pegatron to Radiance and Lumentum experience sharp share price declines during the Christmas 2017 holiday quarter. Foxconn, one of the major upstream suppliers for Apple iPhones and iPads, plans cutting costs at least $3 billion in 2019. In light of anemic demand for iPhones and iPads, Foxconn derives more than half of its revenue from Apple and now needs to reduce non-technical staff by at least 10%.

Foxconn faces a difficult and competitive year ahead.

As Goldman sets a lower share price target for Apple after the prior round of double cuts, this change triggers adverse ripple effects on the upstream assemblers from Foxconn to Pegatron. Foxconn assembles iPhones, tablets, laptop computers, and Sony PlayStations at factories in China, Taiwan, and America. As the smartphone market wanes and weakens in recent times, Sino-U.S. trade tensions exacerbate global economic policy uncertainty. Foxconn flagship technology conglomerates post net profits 12% below stock market analyst expectations as of late-November 2018. As the main facial recognition technology provider for Apple, Lumentum also experiences a 9% share price decline in recent times.

Other Apple upstream suppliers such as Pegatron and Radiance expect to receive more favorable net income results after the festive Christmas season.

Apple now diversifies its smartphone provision into 3 key product lines (i.e. iPhone XS, iPhone XS Max, and iPhone XR). The Apple value chain can reap the fruits of core business process improvements only when the average retail price increase outweighs the imminent decline in smartphone sale volume. Due to a relatively low price elasticity of demand for iPhones and iPads, the Apple value chain expects to rebound in share price performance in the next few months. In terms of technology transfer, most flagship smartphones from Apple and Samsung to Huawei, Oppo, and Vivo now employ organic light-emitting diode (OLED) curvy touch screens to ensure better resolution and facial recognition. In comparison, the more affordable iPhone XR and Xiaomi smartphones make productive use of liquid crystal display (LCD) flat touch screens for high resolution. As most of these flagship smartphones target early technology adopters and gadget lovers, more affordable smartphones attract mainstream users who are responsive to price and quality improvements. In equilibrium, this multi-market competition helps maintain mutual forbearance.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-11-14 08:24:00 Tuesday ET

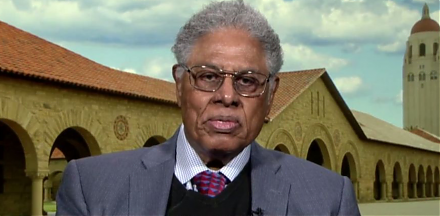

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2018-12-20 13:40:00 Thursday ET

T-Mobile and Sprint indicate that the U.S. is likely to approve their merger plan as they take the offer from foreign owners to stop using HuaWei telecom te

2024-10-31 09:26:00 Thursday ET

Generative artificial intelligence (Gen AI) uses large language models (LLM) and content generation tools to enhance human lives with better productivity.

2025-10-05 17:31:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-02 17:39:00 Friday ET

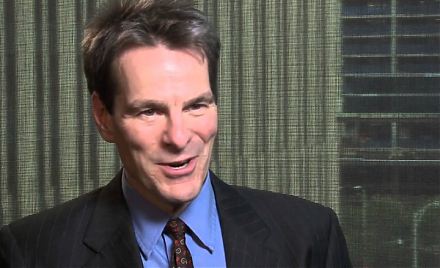

The Phillips curve becomes the Phillips cloud with no inexorable trade-off between inflation and unemployment. Stanford finance professor John Cochrane disa

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.