2019-01-09 07:33:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he cannot blame external factors for selling fewer iPhones in the Christmas holiday quarter. However, Apple fails to acknowledge the real possibility that the new iPhone prices may be too high. Apple iPhone prices are about 5 times higher than the average non-iOS smartphones sold by HuaWei, Oppo, and Vivo. The high-end smartphone market may be fully mature with longer replacement cycles. This tech trend poses a major long-term challenge to Apple.

There are at least 3 solutions to weaker global demand for iPhones. First, Apple can broaden the scope of short-term programs for renting pricey iPhones. These rental programs can help transform high-end Apple iPhones into more affordable options. Second, Apple can consider introducing fresh media services in addition to Apple Music. Apple can apply the profitable business models of iTunes and App Store to real-time video streams, games, and several other entertainment outlets. Third, Apple can take advantage of offshore cash repatriation to fund acquisitions of media service providers. These solutions accord with the current Apple business goal of growing media services to quadruple their sales and profits.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-15 11:35:00 Saturday ET

Apple releases its September 2018 trifecta of smart phones or iPhone X sequels: iPhone Xs, iPhone Xs Max, and iPhone XR. Both iPhone Xs and iPhone Xs Max ha

2019-05-19 19:31:00 Sunday ET

MIT professor and co-author Daron Acemoglu suggests that economic prosperity comes from high-wage job creation. Progressive tax redistribution cannot achiev

2019-05-02 13:30:00 Thursday ET

Netflix has an unsustainable business model in the meantime. Netflix maintains a small premium membership fee of $9-$14 per month for its unique collection

2019-08-16 17:37:00 Friday ET

Amazon faces E.U. antitrust scrutiny over the current e-commerce use of merchant data. The European Commission probes into whether Amazon uses key third-par

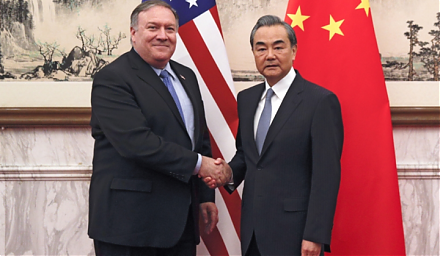

2019-10-01 11:33:00 Tuesday ET

The Trump administration postpones increasing 25% to 30% tariffs on $250 billion Chinese imports after China extends an olive branch to de-escalate Sino-Ame

2018-05-03 07:34:00 Thursday ET

Sprint and T-Mobile propose a major merger in order to better compete with AT&T and Verizon. This mega merger is worth $26.5 billion and involves an all