2017-04-19 17:37:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Apple is now the world's biggest dividend payer with its $13 billion dividend payout and surpasses ExxonMobil's dividend payout record. Despite the slight reduction in the number of iPhone sales in the most recent quarter 2017Q1, Apple CEO Tim Cook looks forward to releasing iPhone X as a brand-new smart phone revolution.

This new product will carry proprietary technologies such as OLED curvy touch screen, facial recognition, wireless charging service, and artificial intelligence.

In addition, Apple plans to initiate sequential share repurchases of at least $200 billion by 2020.

In the next few years, the world's biggest tech giant is likely to expand its media service revenue with the financial trifecta of massive dividend payout, share buyback, and offshore cash repatriation.

This financial trifecta will enable Apple to attract better dividend clienteles of long-run institutional investors with American focus on supply chain automation, domestic job creation, intellectual capital innovation, and even some further acquisition of complementary tech-savvy startups.

This latter horizontal consolidation can travel up the corporate value chain for better vertical integration in terms of both productivity and efficiency gains.

One of Apple's upstream suppliers, Taiwan's Foxconn Technology Group, may establish one or more new plants in America in response to President Trump's macroeconomic expansion.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-19 13:37:00 Friday ET

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations o

2023-05-21 12:26:00 Sunday ET

Amy Chua and Jed Rubenfeld suggest that relatively successful ethnic groups exhibit common cultural traits in America. Amy Chua and Jed Rubenfeld (2015)

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider

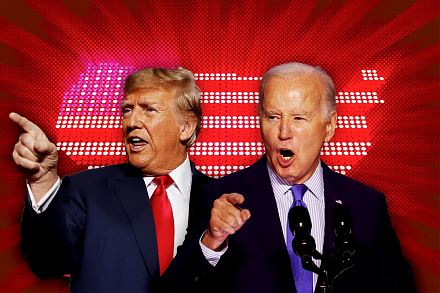

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2019-10-17 08:35:00 Thursday ET

The European Central Bank expects to further reduce negative interest rates with new quantitative government bond purchases. The ECB commits to further cutt