2018-08-01 11:43:00 Wed ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones and other mobile devices in 2018Q2 in comparison to 2017Q2. Thanks to its flagship iPhone X, Apple substantially boosts the average price per unit to $724. Due to this higher average price per unit, Apple rakes into $11.5 billion net profits in 2018Q2.

Apple's iPhones remain its most important products and account for about 60% of total revenue. Total sales grow 17% to $53.3 billion with a healthy EPS of $2.2 per share. Services sales also grow 31% to $9.6 billion, thus this trend is on track for services sales to double by 2020.

Apple sits on more than $240 billion cash stockpiles and now plans to return to its shareholders in the form of $100 billion share repurchases. In response, the stock market rewards this outperformance with a whopping 5% share price increase.

Apple's ascent beyond $1 trillion in stock market value then confirms a remarkable turnaround from the brink of bankruptcy about 2 decades ago. Meanwhile, Apple CEO Tim Cook needs to evaluate the effect of new tariffs on Chinese imports that may affect Apple Watch sales in recent consultation with the Trump administration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-03 08:38:00 Wednesday ET

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an

2019-08-16 17:37:00 Friday ET

Amazon faces E.U. antitrust scrutiny over the current e-commerce use of merchant data. The European Commission probes into whether Amazon uses key third-par

2018-03-27 07:33:00 Tuesday ET

CNBC's business anchorwoman Becky Quick interviews Nobel Laureate Joseph Stiglitz on the current trade war between America and China. As America imposes

2025-07-26 09:26:00 Saturday ET

Nir Eyal and Ryan Hoover explain why keystone habits lead us to purchase products, goods, and services in our lives. The Hooked Model can help shine new lig

2019-09-23 12:25:00 Monday ET

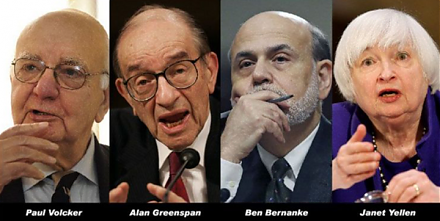

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat