2019-04-17 11:34:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to Amazon shareholders, Bezos points out the fact that the percentage of Amazon goods sold by independent third-parties has gone from 3% in 1999 to about 60% in early-2019. Also, Bezos emphasizes the essential need for Amazon to fail fast forward through numerous informative experiments. In particular, the size of failures has to grow exponentially with the socioeconomic impact of revolutionary inventions such as artificial intelligence, robotic automation, the main strategic healthcare venture with Berkshire Hathaway and JPMorgan Chase, and the landmark acquisition of Whole Foods. With respect to stakeholder value maximization, Bezos plans to pay most Amazon employees, upstream suppliers, and downstream customers with better terms, wages, returns, and benefits.

Meanwhile, Amazon operates at least 10 brick-and-mortar stores in Chicago, San Francisco, and Seattle. Bezos expects to open more Amazon Go brick-and-mortar stores and checkout lines. In light of all the progressive milestones, Amazon may face inevitably closer antitrust scrutiny as the e-commerce tech titan continues to expand its operational scale and scope. A plausible future scenario may entail the strategic separation of Amazon cloud services from the retail business.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-05 07:37:00 Friday ET

Warren Buffett cleverly points out that American children will not only be better off than their parents, but the former will also enjoy higher living stand

2020-10-20 09:36:00 Tuesday ET

Agile lean enterprises remain flexible and capable of reinvention in light of new megatrends such as digitization and servitization. Shane Cragun and Kat

2018-01-01 06:30:00 Monday ET

As former chairman of the British Financial Services Authority and former director of the London School of Economics, Howard Davies shares his ingenious ins

2017-04-25 06:35:00 Tuesday ET

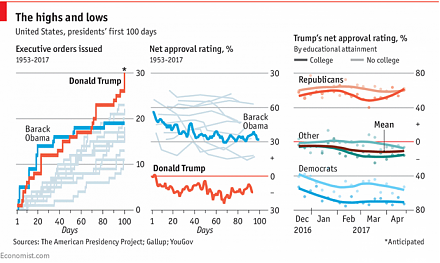

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2019-04-30 19:46:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube April 2019 In this podcast, we discuss several topical issues as of April 2019: (1) Our proprietary

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major