2019-04-17 11:34:00 Wed ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to Amazon shareholders, Bezos points out the fact that the percentage of Amazon goods sold by independent third-parties has gone from 3% in 1999 to about 60% in early-2019. Also, Bezos emphasizes the essential need for Amazon to fail fast forward through numerous informative experiments. In particular, the size of failures has to grow exponentially with the socioeconomic impact of revolutionary inventions such as artificial intelligence, robotic automation, the main strategic healthcare venture with Berkshire Hathaway and JPMorgan Chase, and the landmark acquisition of Whole Foods. With respect to stakeholder value maximization, Bezos plans to pay most Amazon employees, upstream suppliers, and downstream customers with better terms, wages, returns, and benefits.

Meanwhile, Amazon operates at least 10 brick-and-mortar stores in Chicago, San Francisco, and Seattle. Bezos expects to open more Amazon Go brick-and-mortar stores and checkout lines. In light of all the progressive milestones, Amazon may face inevitably closer antitrust scrutiny as the e-commerce tech titan continues to expand its operational scale and scope. A plausible future scenario may entail the strategic separation of Amazon cloud services from the retail business.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

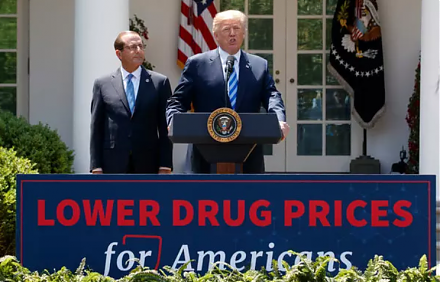

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2019-02-13 11:00:00 Wednesday ET

President Trump may reluctantly sign the congressional border wall deal in order to avert another U.S. government shutdown. With his executive power to decl

2018-10-01 07:33:00 Monday ET

President Trump announces the new trilateral trade agreement among America, Canada, and Mexico: the U.S.-Mexico-Canada Agreement (USMCA) replaces and revamp

2022-05-30 09:32:00 Monday ET

The new semiconductor microchip demand-supply imbalance remains quite severe for the U.S. tech and auto industries. Our current fundamental macro a

2017-10-03 18:39:00 Tuesday ET

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2023-11-28 11:35:00 Tuesday ET

David Colander and Craig Freedman argue that economics went wrong when there was no neoclassical firewall between economic theories and policy reforms. D