2018-04-20 10:38:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thought prior to the Trump administration. Most key countries would benefit from embracing domestic deregulation and free trade and open cross-border capitalism. When the Washington consensus turns into blind faith, however, America suffers the major discontents of financial globalization such as subprime mortgage risks in the global financial crisis from 2008 to 2009.

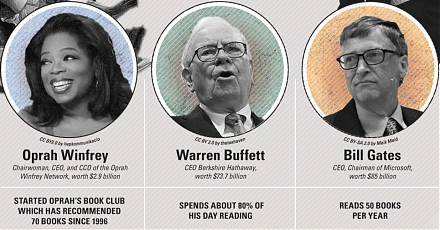

Unemployment surges to unforeseen double digits, capital investment wanes, real productivity protracts, and U.S. residents reap lower disposable income. Secular stagnation emerges from the worst-case scenario where the central bank hits the zero lower bound on interest rates to ease labor-market frictions, whereas, higher prices become inadvertent seigniorage taxes. Political polarization further deepens economic income and wealth inequality.

With socioeconomic advantages such as elite education and political clout, the rich become richer as most of their income and wealth would result from cash dividends and capital gains. El-Erian thus proposes his new consensus on fair trade, artificial intelligence, big data, and greater labor mobility. This new consensus better adapts to the current tech titan dominance in both American labor and capital markets.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-31 14:39:00 Saturday ET

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2018-01-04 07:36:00 Thursday ET

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2017-11-03 06:41:00 Friday ET

Broadcom, a one-time division of Hewlett-Packard and now a semiconductor maker whose chips help power iPhone X, has announced its strategic plans to move it

2018-04-17 12:38:00 Tuesday ET

Value investment strategies make investors wiser like water with core fundamental factor analysis. Value investors tend to buy stocks below their intrinsic

2019-08-12 07:30:00 Monday ET

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (F

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat