2023-01-11 09:26:00 Wed ET

stock market patent asset management uspto asset return prediction fintech network platform algorithmic system investment management

As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent application: Algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

On 4 March 2021, we filed a U.S. patent continuation application (Application Number: #17192059; Publication Number: US20210192628) with a new set of claims in accordance with the April 2017 initial application (Application Number: #15480765; Publication Number: US20180293656).

We went through many USPTO office actions, rejections, failures, setbacks, and other technical obstacles. Eventually, our patent efforts came to fruition in time. We paid the USPTO maintenance fees to secure our patent protection and accreditation for 20 years.

The current invention comprises several additional features and elements of transformative utility. These additional features and elements collectively constitute an inventive concept of accurate algorithmic asset return prediction that represents a significant improvement over the prior art of basic data storage technology, an abstract idea, or a routine and conventional industry practice. This inventive concept effectuates the technical transformation of raw data from one state (i.e. asset prices and returns) to another new, useful, and significantly better state (i.e. both static and dynamic conditional alphas as supernormal excess returns). These additional features and elements integrate the abstract idea of asset return prediction into a practical application for the cloud fintech social network platform with user engagement. This broader cloud fintech social network platform serves as the inventive concept with a specific combination of the additional features and elements for the above technical transformation. These additional features and elements include:

In combination, these 5 core additional technical features and elements integrate the current invention for more accurate asset return prediction into the practical application available on the broader fintech social network platform (Step 2A-Prong 2: YES). As a result, the practical application serves as a specific technical improvement that is significantly more than all the prior art in association with algorithmic asset return prediction. Thus, Claims 1 to 20 recite a specific improvement to a particular cloud-driven technique for the practical application of algorithmic asset return prediction on the broader fintech social network platform (Step 2A-Prong 2: YES).

The dynamic conditional multi-factor model comprises at least 6 fundamental factors (i.e. size, value, momentum, asset growth, operating profitability, and asset market premium). Each fundamental factor is the average return spread between the top 30% and bottom 30% of individual assets that the econometrician sorts on a major asset attribute out of the above 6 fundamental characteristics. As shown in Examples #1 and #2 in the current invention, the evidence demonstrates the explanatory power and statistical significance of these fundamental factors (i.e. Equations #1 and #2). On the key basis of our empirical evidence, this dynamic conditional multi-factor model helps construct algorithmic asset portfolios that produce positive returns at least 90%+ of the time (in contrast to the 70% fair chance for the static counterparts).

The recursive multivariate filter helps extract dynamic conditional factor premiums (i.e. dynamic conditional alphas and betas) from the above multi-factor model for asset return prediction. These dynamic conditional factor premiums vary over time at both the high-and-low daily and monthly frequencies (cf. Examples #1 and #2 in the current invention). We provide the technical details of the practical implementation of recursive multivariate filtration in Equations #3 to #9 and explanatory text therein. This recursive multivariate filtration accounts for new time variation in dynamic conditional factor premiums. All prior art and other literature cannot take into account this dynamism.

The conditional specification test can help statistically distinguish the static and dynamic conditional alpha predictions. As Examples #1 and #2 empirically suggest, this new test provides econometric evidence in favor of the dynamic conditional multi-factor model for about 63%-75% of the individual assets and asset portfolios. Hence, the new and useful dynamic conditional multi-factor model significantly outperforms the static counterparts with similar factors (as our chosen 6 fundamental factors often significantly correlate with economic fluctuations at the conventional statistical significance level). We provide the technical details of the practical use of conditional specification test in Equations #10 to #21 and explanatory text therein.

The algorithmic system comprises a cloud fintech social network platform with mutual user engagement as well as a rich and significant financial intelligence output module (cf. Figures #1 and #2). As the chosen internal cloud server can interact with more than one external cloud server, this cloud-computing module integrates several sources of financial intelligence, information, and social user engagement. The sources encompass both static and dynamic conditional factor premiums (asset-specific alphas and betas), proprietary dynamic conditional alpha rank order results, 80%+ accuracy ratios, 75%+ concordance ratios, Akaike information criteria, Sharpe ratios, average excess returns, return volatilities, conditional specification test χ2 statistics and p-values, major financial ratios, and financial statements (such as balance sheets, income statements, and cash flow statements). As a result, the cloud fintech network platform serves as a significant improvement over the prior art of basic database technology.

With its practical implementation, the current invention applies to both daily individual asset returns as well as monthly international asset portfolio returns for stocks, bonds, currencies, and commodities (cf. Examples #1 and #2 in the current invention). This significant improvement draws a major distinction between the current invention and the prior art, the latter of which focuses on the month-to-month asset portfolio returns for stocks, indices, or mutual funds. In contrast, the present invention delves into the high-frequency dependence structure of both individual asset returns and portfolio returns from day to day (where the individual assets can be stocks, bonds, currencies, indices, and commodities). This rich substance represents a significant improvement in terms of both broader and more granular financial asset return predictions.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-11-15 10:30:00 Tuesday ET

Stock market misvaluation and corporate investment payout The behavioral catering theory suggests that stock market misvaluation can have a first-order

2018-10-01 07:33:00 Monday ET

President Trump announces the new trilateral trade agreement among America, Canada, and Mexico: the U.S.-Mexico-Canada Agreement (USMCA) replaces and revamp

2017-10-09 09:34:00 Monday ET

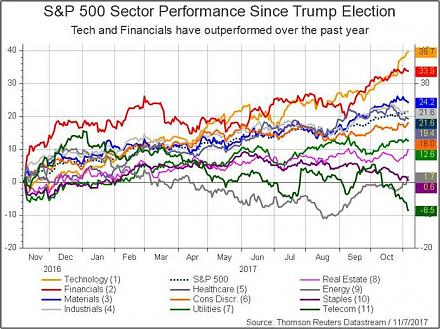

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2025-07-01 13:35:00 Tuesday ET

In recent times, financial deglobalization and asset market fragmentation can cause profound public policy implications for trade, finance, and technology w

2019-05-07 09:30:00 Tuesday ET

The Trump team receives a 3.2% first-quarter GDP boost as Fed Chair Jay Powell halts the next interest rate hike in early-May 2019. This smooth upward econo