Search results : asset price fluctuations

2026-02-02 12:30:00 Monday ET

2025-02-02 11:28:00 Sunday ET

2024-03-26 09:30:00 Tuesday ET

2024-02-04 08:28:00 Sunday ET

2023-12-04 12:30:00 Monday ET

2023-07-28 11:28:00 Friday ET

2023-06-07 10:27:00 Wednesday ET

2023-04-28 16:38:00 Friday ET

2023-04-14 13:32:00 Friday ET

2023-02-03 08:27:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-05-14 12:35:00 Thursday ET

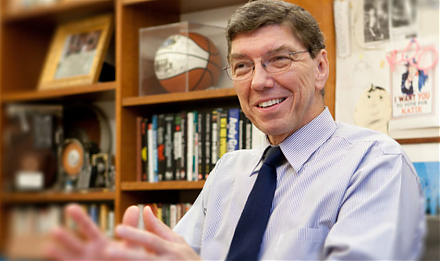

Disruptive innovators can better compete against luck by figuring out why customers hire products and services to accomplish jobs. Clayton Christensen, T

2018-07-30 11:36:00 Monday ET

Trumpism may now become the new populist world order of economic governance. Populist support contributes to Trump's 2016 presidential election victory

2018-06-07 10:36:00 Thursday ET

AT&T wins court approval to take over Time Warner with a trademark $85 billion bid despite the Trump administration prior dissent due to antitrust conce

2017-01-11 11:38:00 Wednesday ET

Thomas Piketty's recent new book *Capital in the Twenty-First Century* frames income and wealth inequality now as a global economic phenomenon. When

2022-11-30 09:26:00 Wednesday ET

Climate change and ESG woke capitalism In recent times, the Biden administration has signed into law a $375 billion program to better balance the economi

2017-12-01 06:30:00 Friday ET

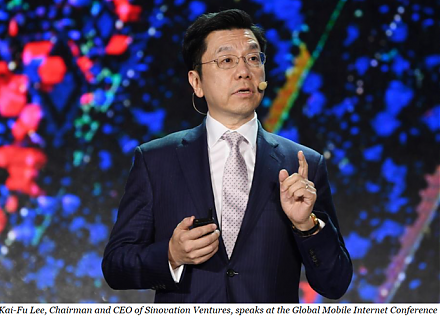

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M