Search results : asset price fluctuations

2026-02-02 12:30:00 Monday ET

2025-02-02 11:28:00 Sunday ET

2024-03-26 09:30:00 Tuesday ET

2024-02-04 08:28:00 Sunday ET

2023-12-04 12:30:00 Monday ET

2023-07-28 11:28:00 Friday ET

2023-06-07 10:27:00 Wednesday ET

2023-04-28 16:38:00 Friday ET

2023-04-14 13:32:00 Friday ET

2023-02-03 08:27:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-29 07:38:00 Monday ET

President Donald Trump delivers his first state-of-the-union address. Several key highlights touch on economic issues from fiscal stimulus and trade protect

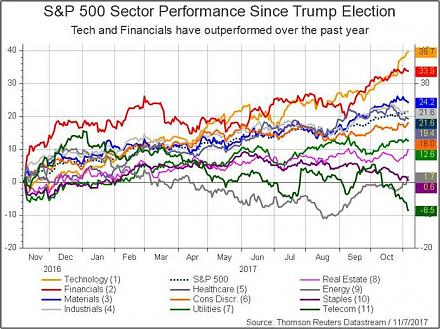

2017-10-09 09:34:00 Monday ET

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2019-10-19 16:35:00 Saturday ET

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and

2026-10-31 12:38:00 Saturday ET

Today tech titans and billionaires continue to reshape global pharmaceutical investments for both better healthspan and longer lifespan. We discuss, desc

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2017-08-19 14:43:00 Saturday ET

In a recent tweet, President Donald Trump criticizes Amazon over taxes and jobs. Without providing specific evidence, Trump accuses of the e-commerce retail