Search results : andrei shelifer

2023-09-14 09:28:00 Thursday ET

2023-07-28 11:28:00 Friday ET

2022-11-15 10:30:00 Tuesday ET

2022-11-05 11:32:00 Saturday ET

2022-10-25 11:31:00 Tuesday ET

2022-04-15 10:32:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-01 09:27:00 Wednesday ET

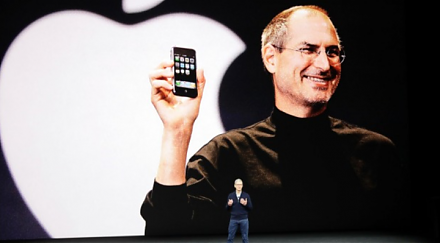

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker

2019-09-03 14:29:00 Tuesday ET

Due to U.S. tariffs and other cloudy causes of economic policy uncertainty, Apple, Nintendo, and Samsung start to consider making tech products in Vietnam i

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2020-05-14 12:35:00 Thursday ET

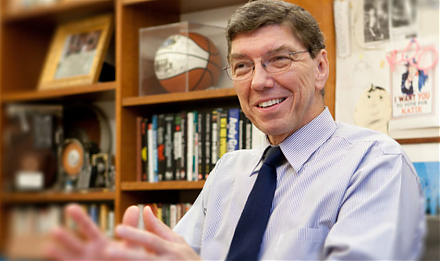

Disruptive innovators can better compete against luck by figuring out why customers hire products and services to accomplish jobs. Clayton Christensen, T

2018-03-05 07:34:00 Monday ET

Peter Thiel shares his money views of President Trump, Facebook, Bitcoin, global finance, and trade etc. As an early technology adopter, Thiel invests in Fa