2022-09-15 11:38:00 Thursday ET

Capital structure choices for private firms The Kauffman Firm Survey (KFS) database provides comprehensive panel data on 5,000+ American private firms fr

2022-02-22 09:30:00 Tuesday ET

The global asset management industry is central to modern capitalism. Mutual funds, pension funds, sovereign wealth funds, endowment trusts, and asset ma

2019-08-30 11:35:00 Friday ET

The conventional wisdom suggests that chameleons change their skin coloration to camouflage their presence for survival through Darwinian biological evoluti

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins

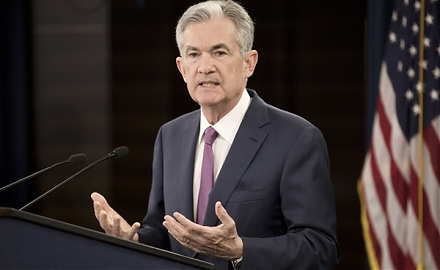

2019-01-08 17:46:00 Tuesday ET

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases