Weibo Corporation operates as a social media platform for people to create, distribute and discover Chinese-language content. The Company operates in two segments: Advertising and Marketing Services, and Other Services. The company offers self-expression products; social products; discovery products; notifications; third-party online games. Weibo also develops mobile apps, such as Weibo Headlines; Weibo Weather and WeiDisk. It also provides advertising and marketing solutions, including social display ads and promoted marketing products. Weibo Corporation is headquartered in Beijing, China....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-07-14 10:32:00 Friday ET

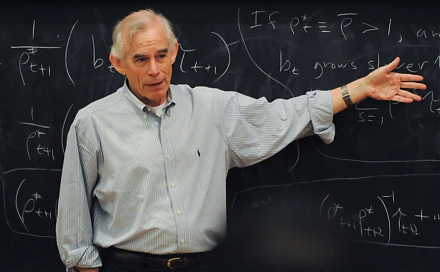

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

2019-03-23 09:31:00 Saturday ET

Congresswoman Alexandria Ocasio-Cortez proposes greater public debt finance with minimal tax increases for the Green New Deal. In accordance with the modern

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no

2025-07-05 11:23:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why working with emotional intelligence helps hone our social skills f

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2020-10-06 09:31:00 Tuesday ET

Strategic managers envision lofty purposes to enjoy incremental consistent progress over time. Allison Rimm (2015) The joy of strategy: a bu