Five9 provides cloud software for contact centers. The Company offers software products such as workforce management, speech recognition, predictive dialer, and voice applications. It offers virtual contact center cloud platform that acts as the hub for interactions between its clients and their customers, enabling contact center operations focused on inbound or outbound customer interactions in a single unified architecture. The Company serves customers in various industries, including banking and financial services, business process outsourcers, consumer, healthcare, and technology. Five9, Inc. is headquartered in San Ramon, California....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-07-27 10:35:00 Friday ET

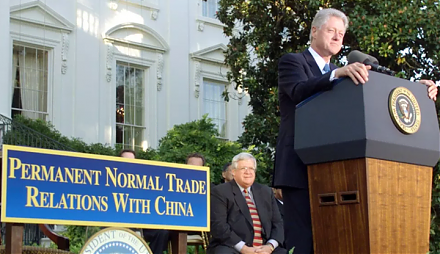

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2019-07-29 11:33:00 Monday ET

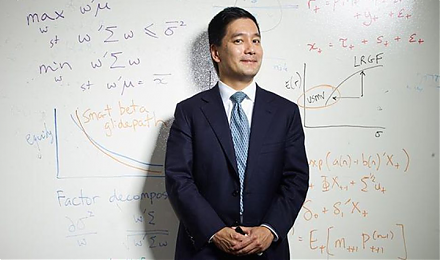

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an inter

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

2018-10-19 13:37:00 Friday ET

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations o

2018-10-05 10:38:00 Friday ET

A 7-year $1.3 billion hedge fund manager Chelsea Brennan shares her investment advice. Her advice encompasses several steps toward better financial literacy