CMB.TECH builds, owns, operates and designs marine and industrial applications which run on dual-fuel diesel-hydrogen and diesel-ammonia engines and monofuel hydrogen engines. The company offers hydrogen and ammonia fuel which is either produces or sources from external produces to its customers. CMB.TECH, formerly known as Euronav NV, is based in Antwerp, Belgium....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-09-13 19:38:00 Thursday ET

Bill Gates shares with Mark Zuckerberg his prior personal experiences of testifying on behalf of Microsoft before U.S. Congress. Both drop out of Harvard to

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2017-11-25 06:34:00 Saturday ET

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement o

2019-08-18 11:33:00 Sunday ET

House Judiciary Committee summons senior executive reps of the tech titans to assess online platforms and their market power. These companies are Facebook,

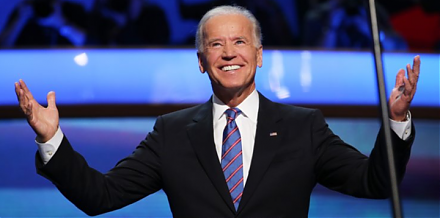

2019-05-05 10:34:00 Sunday ET

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (