Caleres, Inc. is a footwear retailer and wholesaler. The Company is involved in the operation of retail shoe stores and e-commerce Websites as well as the design, sourcing and marketing of footwear for women and men. Its operating segment consists of Famous Footwear and Brand Portfolio. The company brands include Nike, Skechers, Bearpaw, Converse, Vans, New Balance, adidas, Asics, Sperry and Sof Sole, LifeStride, Dr. Scholl's, Fergalicious, Naturalizer and Carlos. Caleres, Inc., formerly known as Brown Shoe Company, Inc., is headquartered in St. Louis, Missouri....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-10-15 09:33:00 Monday ET

Several pharmaceutical companies now switch their primary focus from generic prescription drugs to medical specialties such as cardiovascular medications an

2017-08-01 09:40:00 Tuesday ET

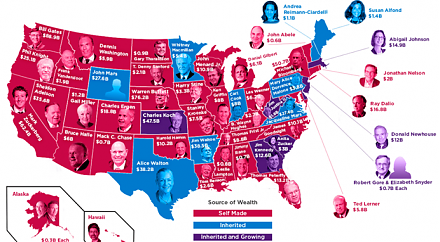

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2019-07-01 12:35:00 Monday ET

Apple releases the new iOS 13 smartphone features. These features include Dark Mode, Audio Share, Memoji, better privacy protection, smart photo collection,

2025-07-26 09:26:00 Saturday ET

Nir Eyal and Ryan Hoover explain why keystone habits lead us to purchase products, goods, and services in our lives. The Hooked Model can help shine new lig

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c

2018-12-01 11:37:00 Saturday ET

As the solo author of the books Millionaire Next Door and Richer Than Millionaire, William Danko shares 3 top secrets for *better wealth creation*. True pro