JOHN HANCOCK BK & THRIFT OPP. The Fund is a closed-end, diversified management investment company whose investment objective is long-term capital appreciation. Investment Adviser: John Hancock Advisers, Inc.Advisory Agreement: Under the terms of the agreement, the Fund pays amonthly management fee to the Adviser, for a continuous investment program,equivalent on an annual basis to 1.15% of the Fund's average weekly netasset value....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-10-13 10:44:00 Saturday ET

Dow Jones tumbles 3% or 831 points while NASDAQ tanks 4%, and this negative investor sentiment rips through most European and Asian stock markets in early-O

2020-05-28 15:37:00 Thursday ET

Platform enterprises leverage network effects, scale economies, and information cascades to boost exponential business growth. Laure Reillier and Benoit

2018-07-03 11:42:00 Tuesday ET

President Trump's current trade policies appear like the Reagan administration's protectionist trade policies back in the 1980s. In comparison to th

2018-09-29 12:39:00 Saturday ET

The Securities and Exchange Commission (S.E.C.) sues Elon Musk for his August 2018 tweet that he has secured external finance to convert Tesla into a privat

2019-01-27 12:39:00 Sunday ET

British Prime Minister Theresa May faces her landslide defeat in the parliamentary vote 432-to-202 against her Brexit deal. British Parliament rejects the M

2017-12-13 06:39:00 Wednesday ET

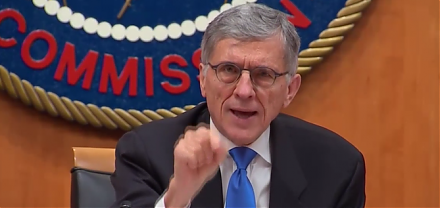

The Federal Communications Commission (FCC) has decided its majority vote to dismantle rules and regulations of most Internet service providers (ISPs) that