Biostar Pharmaceuticals, Inc. (Biostar), incorporated on March 27, 2007, is a holding company. The Company, through its subsidiary, Shaanxi Biostar Biotech, Ltd. (Shaanxi Biostar), and its variable interest entities (VIEs), Shaanxi Aoxing Pharmaceutical Co., Ltd. (Aoxing Pharmaceutical) and Shaanxi Weinan Huaren Pharmaceuticals Ltd. (Shaanxi Weinan), develops, manufactures and markets pharmaceutical products for various diseases and conditions in the People's Republic of China (PRC or China). The Company offers over-the-counter (OTC) products and prescription-based pharmaceuticals. The Company's products are derived from medicinal herbs that are either grown at its own facility or purchased from its suppliers. The Company's products are sold in approximately 30 provinces in the PRC through a network of over 60 distributors and through approximately 230 sales people. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-10-09 09:34:00 Monday ET

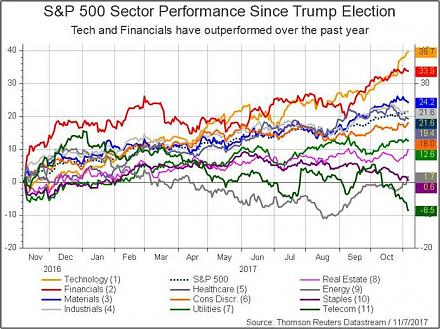

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2020-08-12 07:25:00 Wednesday ET

Most sustainably successful business leaders make a mark in the world, create a positive impact, and challenge the status quo. Jerry Porras, Stewart Emer

2025-06-20 08:27:00 Friday ET

President Trump poses new threats to Fed Chair monetary policy independence again. We describe, discuss, and delve into the mainstream reasons, conc

2018-05-08 13:39:00 Tuesday ET

The Trump administration weighs the pros and cons of a potential mega merger between AT&T and Time Warner. Recent stock prices show favorable trends for

2019-02-28 20:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube February 2019 In this podcast, we discuss several topical issues as of February 2019: (1) our proprieta

2020-03-05 08:28:00 Thursday ET

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s