Blue Hills Bancorp, Inc. (Blue Hills Bancorp), incorporated on February 27, 2014, is a bank holding company for the Blue Hills Bank (the Bank). Blue Hills Bank is a Massachusetts-chartered savings bank. As of December 31, 2016, the Bank provided financial services to individuals, families, small to mid-size businesses and government and non-profit organizations online and through its 11 full-service branch offices located in Brookline, Dedham, Hyde Park, Milton, Nantucket, Norwood, West Roxbury, and Westwood, Massachusetts. It also operates loan production offices in Boston, Cambridge, Franklin, Plymouth, Winchester, Hingham, Concord and Lowell, Massachusetts. Its primary deposit-taking market includes Norfolk, Suffolk and Nantucket Counties in Massachusetts, and its lending market is primarily based in eastern Massachusetts. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-08-05 08:33:00 Wednesday ET

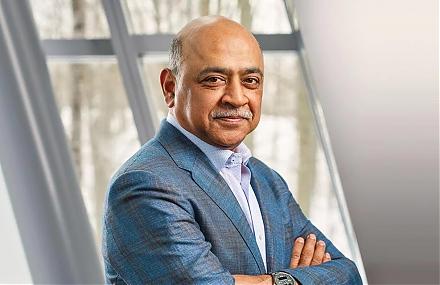

Business leaders often think from a systemic perspective, share bold visions, build great teams, and learn new business models. Peter Senge (2006) &nb

2018-03-25 08:39:00 Sunday ET

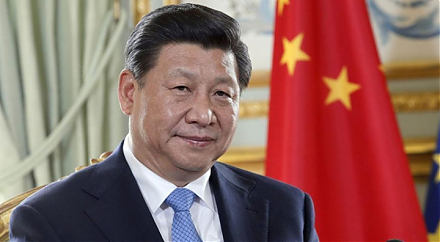

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2020-11-01 11:21:00 Sunday ET

Artificial intelligence continues to push boundaries for several tech titans to sustain their central disruptive innovations, competitive moats, and first-m

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-03-03 11:37:00 Saturday ET

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de