Aradigm Corporation, incorporated on January 30, 1991, is a specialty pharmaceutical company focused on the development and commercialization of products for the treatment and prevention of severe respiratory diseases. It is focused on commercializing its products in the United States, European Union (EU), Japan and China. The Company's lead product candidate is Pulmaquin inhaled ciprofloxacin, which is in Phase III clinical trials. The Company offers AERx pulmonary drug delivery platform and other technologies. The Company's partnered programs under development include Inhaled Ciprofloxacin. The Company is also engaged in developing Smoking Cessation Therapy (ARD-1600 Inhaled Nicotine). The Company is focused on inhaled nicotine product utilizing its AERx delivery system that is focused on addressing the acute craving for cigarettes and, through gradual reduction of the peak nicotine levels, could wean-off patients from cigarette smoking and from the nicotine addiction. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-12-08 08:28:00 Friday ET

Tax policy pluralism for addressing special interests Economists often praise as pluralism the interplay of special interest groups in public policy. In

2018-12-15 14:38:00 Saturday ET

Google CEO Sundar Pichai makes his debut testimony before Congress. The post-mid-term-election House Judiciary Committee bombards Pichai with key questions

2019-07-03 11:35:00 Wednesday ET

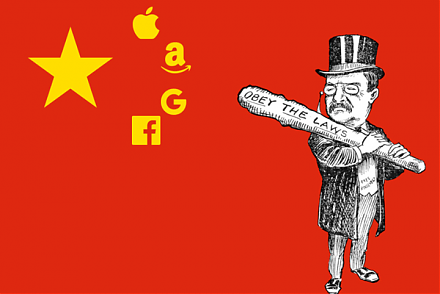

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2023-05-28 10:24:00 Sunday ET

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs

2019-04-29 08:35:00 Monday ET

IMF chief economist Gita Gopinath predicts no global recession with key downside risks at this delicate moment. First, trade tensions remain one of the key

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen