A-Mark Precious Metals, Inc. operates as a full service precious metals trading company offering a wide array of products and services. The Company's products include gold, silver, platinum and palladium for storage and delivery in the form of coins, bars, wafers and grain. Its services include financing, leasing, consignment, hedging and a variety of customized financial programs. The Company's clients include coin and metal dealers, investors, collectors, mines, manufacturers, refiners, jewelers, investment advisors, merchants, commodity brokerage houses and central banks. A-Mark Precious Metals, Inc. is based in Santa Monica, California....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2022-10-05 08:24:00 Wednesday ET

Precautionary-motive and agency reasons for corporate cash management Bates, Kahle, and Stulz (JF 2009) empirically find that public firms have doubled t

2018-12-07 11:35:00 Friday ET

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo

2017-11-24 08:41:00 Friday ET

Is Bitcoin a legitimate (crypto)currency or a new bubble waiting to implode? As its prices skyrocket, bankers, pundits, and investors increasingly take side

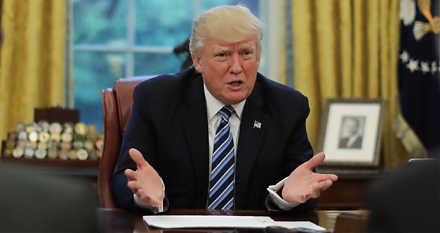

2017-07-01 08:40:00 Saturday ET

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructur

2018-05-11 09:37:00 Friday ET

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2

2019-08-14 10:31:00 Wednesday ET

Netflix suffers its first major loss of U.S. subscribers due to the recent price hikes. The company adds only 2.7 million new subscribers in 2019Q2 in stark