American Eagle Outfitters Inc. is a specialty retailer of casual apparel, accessories, outerwear and footwear for men and women. It, along with its subsidiaries, engages in the designing and marketing of casual clothing. The company operates under the American Eagle (AE) Brand, Aerie by American Eagle and an online retailing channel, AEO Direct. AE Brand: Under this brand, the company sells latest fashion apparel and accessories for men and women in the age group of 15-25 years. Aerie by American Eagle: Aerie is a lifestyle brand providing simple and stylish apparel, especially for young girls. The company sells apparel through its standalone Aerie stores across the U.S. and Canada, and globally through its online channel, aerie.com. AEO Direct: Through this online retail channel, it sells a wide range of apparel and accessories from its different brands. It merchandises its products through e-commerce websites, ae.com and aerie.com....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-07-21 13:35:00 Saturday ET

President Trump supports a bipartisan bill or the Foreign Investment Risk Review Modernization Act (FIRRMA), which effectively broadens the jurisdiction of

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)

2023-08-14 09:25:00 Monday ET

Peter Isard analyzes the proper economic policy reforms and root causes of global financial crises of the 1990s and 2008-2009. Peter Isard (2005) &nbs

2018-01-04 07:36:00 Thursday ET

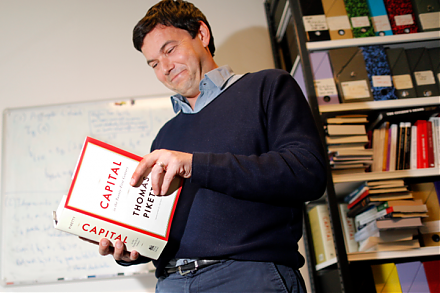

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2019-06-13 10:26:00 Thursday ET

The Chinese Xi administration may choose to leverage its state dominance of rare-earth elements to better balance the current Sino-U.S. trade war. In recent

2018-04-26 07:37:00 Thursday ET

Credit supply growth drives business cycle fluctuations and often sows the seeds of their own subsequent destruction. The global financial crisis from 2008