BLDRS Emerging Markets 50 ADR Index Fund (the Fund) is a unit investment trust designed to provide investment results that correspond generally to the price and yield performance of the publicly traded depositary receipts comprising The Bank of New York Emerging Markets 50 ADR Index. As of September 30, 2006, The BNY Emerging Markets 50 ADR Index included 50 component depositary receipts representing the securities issued by 50 of the most actively traded companies from the international and emerging markets having a free-float market capitalization ranging from approximately $3 billion to over $30 billion. ...

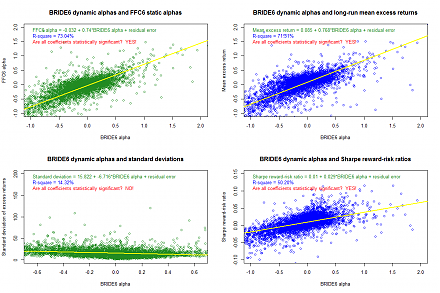

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-01-09 10:31:00 Monday ET

Response to USPTO fintech patent protection As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent

2023-05-31 03:15:40 Wednesday ET

The U.S. further derisks and decouples from China. Why does the U.S. seek to further economically decouple from China? In recent times, th

2024-04-02 04:45:41 Tuesday ET

Stock Synopsis: High-speed 5G broadband and mobile cloud telecommunication In the U.S. telecom industry for high-speed Internet connections and mobile cl

2019-10-09 16:46:00 Wednesday ET

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form

2025-09-16 09:27:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2025-08-09 11:31:00 Saturday ET

Wharton e-commerce entrepreneurship professor Dr Karl Ulrich explains that many top-notch universities now provide massive open online courses (MOOCs) for m