2018-10-23 12:36:00 Tuesday ET

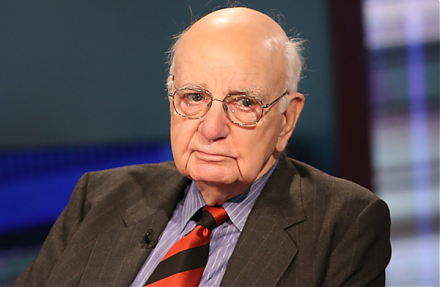

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2019-01-11 10:33:00 Friday ET

The Economist Intelligence Unit (EIU) continues to track major business risks in light of volatile stock markets, elections, and geopolitics. EIU monitors g

2019-07-11 10:48:00 Thursday ET

France and Germany are the biggest beneficiaries of Sino-U.S. trade escalation, whereas, Japan, South Korea, and Taiwan suffer from the current trade stando

2019-07-17 12:37:00 Wednesday ET

Gold prices surge above $1400 per ounce amid global trade tension and economic policy uncertainty. Both European Central Bank and Bank of Japan may consider

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2018-07-01 08:34:00 Sunday ET

Are China and Russia etc gonna dethrone the petrodollar? Over the years, China, Russia, France, Germany, and Japan have made numerous attempts to use their