Home > Library > USPTO patent publication: Algorithmic system for asset return prediction and fintech network platform automation

Author Andy Yeh Alpha

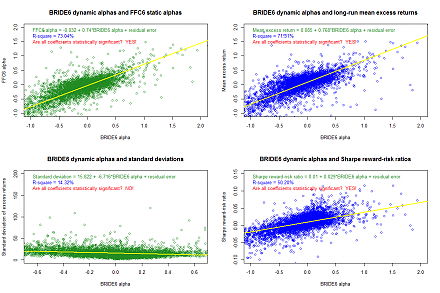

This USPTO patent publication delves into our algorithmic system for dynamic conditional asset return prediction and fintech network platform automation. The current invention pertains to the novel, non-obvious, and applicable design and development of an algorithmic system for dynamic conditional asset return prediction and fintech network platform automation. Core technicality entails the consistent estimation of dynamic conditional alphas after the econometrician controls for myriad fundamental characteristics such as size, value, momentum, profitability, asset investment growth, and market risk through recursive multivariate filtration. Conditional specification test evidence supports the use of the dynamic conditional multifactor model for asset return prediction against the static alternatives. The fintech network platform allows users to interact with one another by transmitting valuable units of financial intelligence and information in an online social network. The information units include dynamic conditional alpha rank order, key financial ratio summary, quadripartite visualization of financial data, and financial statement analysis. The fintech network platform automates social network functions for better interactive engagement through minimum viable cloud computing facilities for mobile app design.

Description:

This USPTO patent publication delves into our algorithmic system for dynamic conditional asset return prediction and fintech network platform automation. The current invention pertains to the new, non-obvious, and applicable econometric design and implementation of an algorithmic system for better risky asset return prediction and financial intelligence technology (fintech) platform automation. The critical elements of new technicality land in our dynamic conditional alpha and beta estimation for better asset return prediction and algorithmic fintech platform automation. The current invention entails the use of a recursive multivariate filter for the econometrician to extract dynamic conditional alpha and beta time-series for more accurate asset return prediction. This statistical analysis suggests a robust positive relation between dynamic conditional alphas and Sharpe ratios of average excess returns to return volatility after the econometrician controls for multiple fundamental characteristics, asset investment styles, and portfolio tilts. These main characteristics are market risk, size, value, momentum, asset growth, and operating profitability. The current invention involves a new rigorous conditional specification test for hypothesis test design and development in risky asset return prediction. In effect, this test helps distinguish the dynamic and static multifactor asset pricing models. The preponderance of our empirical results for U.S. individual stocks and international stock, bond, currency, and commodity portfolios favors the use of dynamic conditional alpha analysis in contrast to static asset return prediction. Through fast and stable cloud computing facilities for mobile web app design and encryption, the current invention automates the dynamic conditional alpha estimation and the algorithmic fintech platform. With a reasonably modular and interactive social network, the fintech platform helps optimize active-click mutual engagement (ACME) among active users through both the centrifugal and centripetal user interactions as well as the time-specific rank order of each active end user’s asset portfolio value ceteris paribus. ACME increases exponentially when the highly modular algorithmic fintech platform boosts these user interactions, improves individual users' dynamic conditional alpha ranks, and/or causes significant changes in structural characteristics such as demographic attributes, interests, behaviors, other platform usage patterns, and so forth.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2018-01-17 05:30:00 Wednesday ET

European Union antitrust regulators impose a fine on Qualcomm for advancing its key exclusive microchip deal with Apple to block out rivals such as Intel an

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2020-04-17 07:23:00 Friday ET

Clayton Christensen defines and delves into the core dilemma of corporate innovation with sustainable and disruptive advances. Clayton Christensen (2000)

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an