Home > Library > The happy story of small business finance

Author Andy Yeh Alpha

This research article empirically tests the financial contentment hypothesis for small business owners in both America and Britain.

Description:

We empirically examine the American and British survey datasets for about 16,000 privately held small businesses. The financial behavior of private firms demonstrates substantial financial contentment. We find fewer than 10% of the British firms seek rapid firm expansion while only 1.32% of American private firms view a lack of capital other than working capital as a major financial problem. Financial performance indicators such as sales growth, return-on-assets, and net profit margin are insignificant determinants of small business finance. This evidence contradicts the conventional financial lifecycle paradigm of Berger and Udell (1995, 1998, 2002). Younger and less educated private-firm owners more actively use external finance even though more education reduces the fear of bank loan denial, whereas, older and wiser small business owners with better education are less likely to tap into external finance.

Our financial contentment hypothesis for privately held firms also extends to small businesses that seek rapid firm expansion. These high-growth firms participate more in the bank loan markets than low-growth firms. In stark contrast to the financing-gap hypothesis of Berger and Udell (1995, 1997, 2002), our financial contentment hypothesis observes the importance of both social networks and connections for small business finance and in turn confirms the empirical nexus between private owner involvement and sustainable growth. In this light, small private firms serve as a robust investment vehicle for long-term sustainable development.

Overall, our empirical evidence sheds skeptical light on the theoretical plausibility of the agency lifecycle prediction that the vast majority of private firms suffer from severe financial constraints or financing gaps (Jensen and Meckling, 1976; Jensen, 1986; Stulz, 1990; Lang, Stulz, and Walking, 1991; Berger and Udell, 1995, 1998, 2002; Ang, Cole, and Lin, 2000; Bitler, Moskowitz, and Vissing-Jorgensen, 2005). The preponderance of our empirical results proposes a case for an alternative theory of corporate finance for privately held firms that differ from publicly traded corporations in many fundamental ways. This proposal calls for a paradigm shift in rethinking about the conventional wisdom that private firms cannot grow as fast as their public counterparts due to a lack of reasonable access to external capital.

2018-09-13 19:38:00 Thursday ET

Bill Gates shares with Mark Zuckerberg his prior personal experiences of testifying on behalf of Microsoft before U.S. Congress. Both drop out of Harvard to

2023-02-21 08:27:00 Tuesday ET

Mark Granovetter follows the key principles of modern economic sociology to analyze social relations and economic phenomena. Mark Granovetter (2017) &

2018-03-01 07:35:00 Thursday ET

Trump imposes high tariffs on steel (25%) and aluminum (10%) in a new trade war with subsequent exemptions for Canada and Mexico. The Trump administration&#

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2017-10-21 08:45:00 Saturday ET

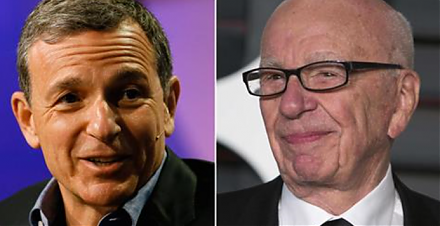

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.

2025-06-05 00:00:00 Thursday ET

Former New York Times team journalist and Pulitzer Prize winner Charles Duhigg describes, discusses, and delves into how we can change our respective lives