2019-01-12 10:33:00 Sat ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

With majority control, House Democrats pass 2 bills to reopen the U.S. government without funding the Trump border wall. President Trump makes a surprise White House appearance to reiterate his intention to keep up the fight for the signature campaign promise of a border wall against Mexico. House Speaker Nancy Pelosi states that both President Trump and Republican Senate should *take yes for an answer* to approve the 2 bills without border wall finance. If President Trump and Republican Senate pass these bills, federal agencies would receive public finance to end the partial government shutdown.

Several House Republicans break with the Trump administration and vote in favor of reopening the U.S. government without any border wall finance. It is unlikely for President Trump and Republican Senate to accept this outcome without any form of border wall finance. Nevertheless, the Trump administration may need to realign stock market investor and taxpayer expectations with no more than $5 billion public finance for the southern border wall. In the best-case scenario, both parties would need to compromise on this budget issue. Otherwise President Trump, Republican Senate, and House Democrats would bear responsibility for public outrage in light of the current government shutdown.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-02 09:35:00 Saturday ET

The finance ministers of Britain, Canada, France, Germany, Italy, and Japan team up against U.S. President Donald Trump and Treasury Secretary Steven Mnuchi

2023-11-14 08:24:00 Tuesday ET

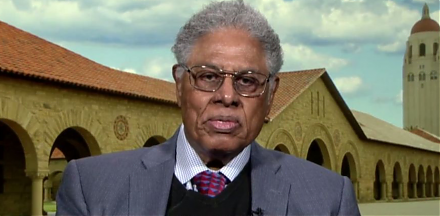

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2018-05-02 06:32:00 Wednesday ET

What are the primary pros and cons of free trade or fair trade in the current Sino-American quagmire? Free trade means allowing goods and services to move a

2019-01-01 03:34:48 Tuesday ET

American allies assist AT&T and Verizon in implementing 5G telecommunication technology in the U.S. as such allies ban the use of HuaWei 5G telecom equi

2019-03-01 13:36:00 Friday ET

Global economic uncertainty now lurks in a thick layer of mystery. This uncertainty arises from Sino-U.S. trade tension, Brexit fallout, monetary policy nor

2025-10-04 13:37:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund