2017-01-11 11:38:00 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Thomas Piketty's recent new book *Capital in the Twenty-First Century* frames income and wealth inequality now as a global economic phenomenon.

When capital wealth grows faster than macroeconomic output (r>g), economic inequality arises as a natural result ceteris paribus.

The Top 1% richest investors own more than 25% of total wealth in America with abundant cash dividends, share repurchases, and capital gains, while at the same time the Top 10% richest investors own more than half of total wealth in America.

While income and wealth redistribution causes inadvertent distortions, Piketty proposes global wealth taxation as a policy antidote to the inequality dilemma.

The major lesson highlights the increasingly important focus on passive income that the typical stock market investor accumulates in the form of both dividend yields and capital gains.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2024-03-19 03:35:58 Tuesday ET

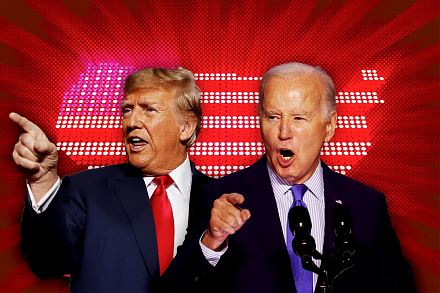

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2019-04-25 09:35:00 Thursday ET

Bridgewater hedge fund founder Ray Dalio suggests that the current state of U.S. capitalism poses an existential threat for many Americans. Dalio deems the

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2017-03-15 08:46:00 Wednesday ET

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creatio

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2023-03-07 11:29:00 Tuesday ET

Former Bank of England Governor Mervyn King provides his deep substantive analysis of the Global Financial Crisis of 2008-2009. Mervyn King (2017) &nb