2018-02-11 07:30:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

President Trump unveils his ambitious $1.5 trillion public infrastructure plan. Trump proposes offering $100 billion in federal incentives to encourage states and cities to invest in roads, bridges, highways, railways, and water utilities etc. The federal incentives help spur $1.5 trillion infrastructure expenditures over the next decade. Transportation Secretary Elaine Chao indicates to the House Transportation and Infrastructure Committee that the Trump team seeks to work with Congress to find bipartisan solutions. All options are on the table, and the Trump administration is open to considering all revenue sources.

This plan calls for allocating at least $200 billion in initial federal funds to encourage states, cities, and the private sector to spur $1.5 trillion infrastructure expenditures over the next decade. Also, this plan would reduce the amount of time for issuing onsite construction permits for infrastructure projects to 2 years.

Since his presidential election victory, Trump has thus far focused on bilateral trade, healthcare, immigration, gun control, and other socioeconomic issues. There may or may not be enough time for passing an infrastructure bill in late-2018.

U.S. lawmakers may need to act fast during a lame-duck interim session after the November 2018 midterm elections.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an

2017-10-15 07:38:00 Sunday ET

Ivanka Trump and Treasury Secretary Steven Mnuchin both press the case for GOP tax legislation as economic relief for the middle-class without substantial t

2019-01-04 11:41:00 Friday ET

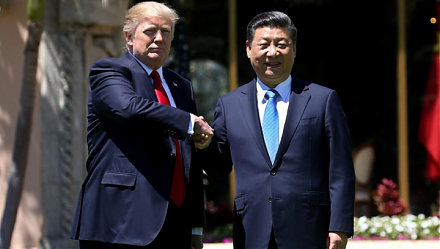

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2020-06-03 09:31:00 Wednesday ET

Lean enterprises often try to incubate disruptive innovations with iterative continuous improvements and inventions over time. Trevor Owens and Obie Fern

2018-10-21 14:40:00 Sunday ET

President Trump floats generous 10% tax cuts for the U.S. middle class ahead of the November 2018 mid-term elections. Republican senators, congressmen, and