2018-11-11 13:42:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears up his presidential bid, and eyes the Democratic nomination for 2020. Bloomberg now actively considers a presidential campaign as a Democrat in 2020, and he figures out that the Democrat nomination would be his only path to the White House even though he voices stark disagreements with many progressive proponents on bank regulation, law enforcement, and the recent #MeToo movement.

At age 76, Bloomberg is a financial media multi-billionaire and a former New York City mayor. On the economic front, Bloomberg considers himself more familiar with macro policy issues and reforms that would better shape U.S. real macro variates such as real GDP per capita, employment, and capital investment etc. Bloomberg has entertained the pragmatic idea of pursuing U.S. presidency many times before, and continues to show little preference for the rough-and-tumble tactics of partisan political discourse. There is a fair chance that Bloomberg receives the Democratic nomination to win the U.S. presidential bid against President Trump. This putative scenario might overturn the Trump set of both supply-side fiscal stimulus and bank deregulation with more realistic structural reforms in education, residential estate, and financial market stabilization.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-08-19 10:32:00 Wednesday ET

Corporate strategies, portfolio choices, and management memes add value and drive business process improvements over time. Andrew Campbell, Jo Whitehead,

2018-01-23 06:38:00 Tuesday ET

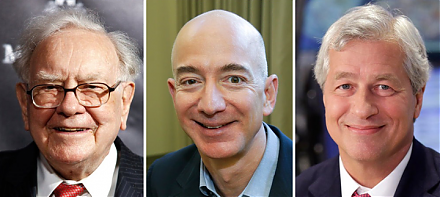

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-12-23 13:39:00 Sunday ET

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As fre

2020-03-12 09:32:00 Thursday ET

Google CEO Eric Schmidt and his co-authors show the innovative corporate culture and mission of the Internet search tech titan. Eric Schmidt, Jonathan Ro

2022-03-05 09:27:00 Saturday ET

Addendum on empirical tests of multi-factor models for asset return prediction Fama and French (2015) propose an empirical five-factor asset pricing mode

2022-02-02 10:33:00 Wednesday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O