2017-11-23 10:42:00 Thu ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the anonymous inventor of Bitcoin. Second, no one knows how much the creator has reserved for himself or herself. There are several other cryptocurrencies such as Ethereum, Ripple, Litecoin, Dash, and NEM as well. Third, there is no transparency in the virtual system for Bitcoin. Fourth, there no explicit or implicit government guarantee or lender of last resort to back up the virtual system for cryptocurrencies such as Bitcoin and Litecoin. Despite the virtual protection of Blockchain for secure Bitcoin transactions, it is possible for aggressive hackers to game this software technology. This latter rationale suggests substantial risk that each Bitcoin investor inevitably needs to address.

Although many investors are now abuzz about Blockchain and Bitcoin etc, it is important for each rational investor to acknowledge the hard and solid fact that U.S. stocks continue to offer the highest average excess return than non-equity securities such as bonds, futures, commodities, currencies, and so on over the long run. For this reason, it is safer to earn an annual 6%-8% average excess return on U.S. stocks with a canonical buy-and-hold passive portfolio strategy. More aggressive active asset management may help boost this average excess return to double digits at the margin.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-11-09 11:35:00 Friday ET

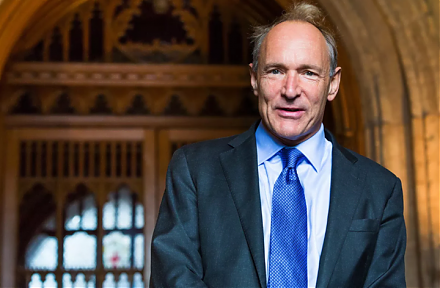

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2020-08-12 07:25:00 Wednesday ET

Most sustainably successful business leaders make a mark in the world, create a positive impact, and challenge the status quo. Jerry Porras, Stewart Emer

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2022-11-15 10:30:00 Tuesday ET

Stock market misvaluation and corporate investment payout The behavioral catering theory suggests that stock market misvaluation can have a first-order

2019-03-25 17:30:00 Monday ET

America seeks to advance the global energy dominance agenda by toppling Saudi Arabia as the top oil exporter by 2024. The International Energy Agency (IEA)

2019-06-03 11:31:00 Monday ET

The Sino-U.S. trade war may be the Thucydides trap or a clash of Caucasian and non-Caucasian civilizations. The proverbial Thucydides trap refers to the his