2019-10-23 15:39:00 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

American CEOs of about 200 corporations issue a joint statement in support of stakeholder value maximization. The Business Roundtable offers this statement of corporate purpose in 300 words. The first 250 words focus on stakeholder value maximization before the statement mentions shareholder wealth maximization. In accordance with this joint statement, the main purpose of a corporation should be investing in both the welfare and productivity of employees, delivering key value to customers, and dealing ethically with suppliers. Also, it is practically important for U.S. corporations to promote better diversity and inclusion in the workplace. These corporations should further support social communities in America. Moreover, the corporations should help protect the environment amid substantial economic policy uncertainty, climate change, and environmental degradation.

This landmark U.S. CEO statement represents an important change in business purpose away from the prior thesis of Nobel Laureate Milton Friedman in support of solo shareholder wealth maximization. This latter emphasis reveals drawbacks and impediments to long-term sustainable business development and corporate social responsibility. In a nutshell, it is essential for U.S. corporations to serve in the best interests of employees, customers, suppliers, regulators, and other major stakeholders before these corporations disgorge cash returns to shareholders.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-07-27 10:35:00 Friday ET

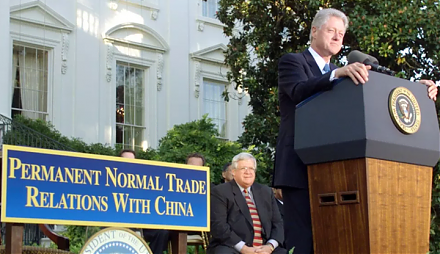

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2019-07-30 15:33:00 Tuesday ET

All of the 18 systemically important banks pass the annual Federal Reserve stress tests. Many of the largest lenders announce higher cash payouts to shareho

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat

2019-09-05 09:26:00 Thursday ET

Yale macro economist Stephen Roach draws 3 major conclusions with respect to the Chinese long-run view of the current tech trade conflict with America. Firs