China Auto Logistics Inc., formerly Fresh Ideas Media, Inc., incorporated on February 22, 2005, is engaged in providing imported automobile sales and trading service, and a Web-based automobile sales and trading information platform to its customers. The Company operates through four segments: sales of automobiles, financing services, airport auto mall automotive services and other services. The Company's subsidiaries include Tianjin Binhai Shisheng Trading Group Co., Ltd., (Shisheng) Tianjin Hengjia Port Logistics Corp. (Hengjia), Tianjin Ganghui Information Technology Corp. (Ganghui), Tianjin Zhengji International Trading Corp. (Zhengji) and Tianjin Zhonghe Auto Sales Service Co., Ltd. (Zhonghe). ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-11-07 08:30:00 Wednesday ET

PwC releases a new study of top innovators worldwide as of November 2018. This study assesses the top 1,000 global companies that spend the most on R&D

2018-02-01 07:38:00 Thursday ET

U.S. senators urge the Trump administration with a bipartisan proposal to prevent the International Monetary Fund (IMF) from bailing out several countries t

2019-07-29 11:33:00 Monday ET

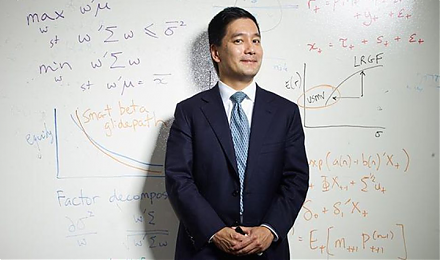

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an inter

2018-02-27 09:35:00 Tuesday ET

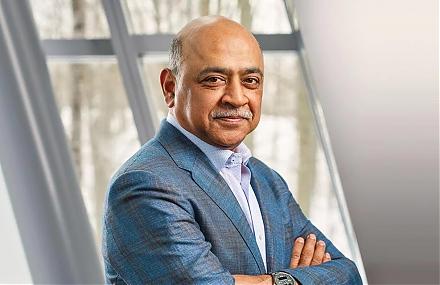

Fed's new chairman Jerome Powell testifies before Congress for the first time. He vows to prevent price instability for U.S. consumers, firms, and finan

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-09-28 08:26:00 Thursday ET

Daron Acemoglu and James Robinson show a constant economic tussle between society and the state in the hot pursuit of liberty. Daron Acemoglu and James R