Tritax Big Box REIT plc is a real estate investment trust (REIT) focused on investing in logistics facilities in the United Kingdom. The Company operates through the investment property segment. Its objectives reflect the Company's aim of creating value for shareholders. It invests in and manages both standing assets and pre-let forward funded developments. The Company focuses on well-located, modern Big Box logistics assets, typically greater than 500,000 square feet, let to institutional-grade tenants on long-term leases (typically at least 12 years in length) with upward-only rent reviews and geographic and tenant diversification throughout the United Kingdom. The Company seeks to exploit the significant opportunity in this sub-sector of the United Kingdom logistics market. Tritax Management LLP is the Company's alternative investment fund manager....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-03-14 16:43:00 Tuesday ET

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes. Thomas Pogge and Krishen

2023-05-14 12:31:00 Sunday ET

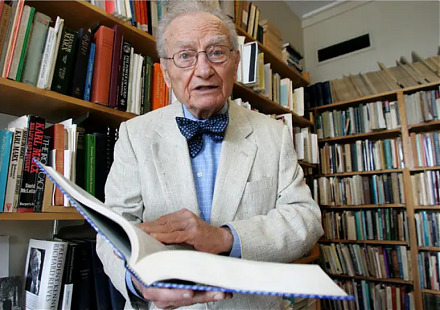

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2018-03-05 07:34:00 Monday ET

Peter Thiel shares his money views of President Trump, Facebook, Bitcoin, global finance, and trade etc. As an early technology adopter, Thiel invests in Fa

2026-01-19 10:30:00 Monday ET

Andy Yeh Alpha (AYA) fintech network platform: major milestones, key product features, and online social media services Introduction

2025-01-31 09:26:00 Friday ET

The current homeland industrial policy stance worldwide seeks to embed the new notion of global resilience into economic statecraft. In the broader cont

2019-02-01 15:35:00 Friday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implem