2019-10-11 13:40:00 Friday ET

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era.

2019-10-07 12:35:00 Monday ET

Federal Reserve reduces the interest rate by another key quarter point to the target range of 1.75%-2% in September 2019. In accordance with the Federal Res

2020-03-26 10:31:00 Thursday ET

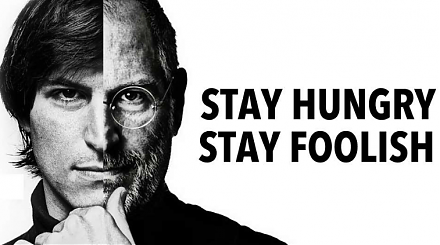

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2017-09-13 10:35:00 Wednesday ET

CNBC reports the Top 5 features of Apple's iPhone X. This new product release can be the rising tide that lifts all boats in Apple's upstream value

2018-03-06 11:35:00 Tuesday ET

The Trump team blocks Broadcom's bid for Qualcomm due to national economic security concerns and 5G telecom network issues. Broadcom makes microchips fo

2022-05-30 09:32:00 Monday ET

The new semiconductor microchip demand-supply imbalance remains quite severe for the U.S. tech and auto industries. Our current fundamental macro a