2017-12-21 12:45:00 Thu ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Tony Robbins summarizes several personal finance and investment lessons for the typical layperson:

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-01-03 08:38:00 Wednesday ET

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an

2023-11-14 08:24:00 Tuesday ET

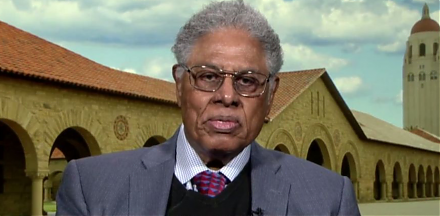

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2026-04-30 08:28:00 Thursday ET

In the current global market for better biotech advances, medical innovations, and healthcare services, the new integration of artificial intelligence (AI)

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c

2019-11-06 12:29:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2023-12-07 07:22:00 Thursday ET

Economic policy incrementalism for better fiscal and monetary policy coordination Traditionally, fiscal and monetary policies were made incrementally. In