2018-08-07 07:33:00 Tue ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

President Trump sounds smart when he comes up with a fresh plan to retire $15 trillion national debt. This plan entails taxing American consumers and producers when they buy goods and services from countries subject to his tariffs. The taxes involve steel and aluminum taxes on western allies such as Canada, Europe, and Mexico as well as another 25% tariffs on $200 billion Chinese imports.

However, math seems to be on the other side of this healthy trade debate.

For the fiscal year 2018, the U.S. Congressional Budget Office projects the federal budget deficit to be $800 billion. The Office of Management and Budget projects an even higher deficit of $1 trillion in 2019. In other words, it is difficult for the Trump administration to remain fiscally neutral due to large infrastructure expenditures, tax cuts, trade barriers, and capital investment restrictions. The new Trump tariffs may bring in $100 billion in light of stable macroeconomic demand for imports from Canada, China, Europe, and Mexico.

In this negative light, the Trump administration may not be able to curtail the current budget deficit. In order for the Trump administration to balance the U.S. budget, it would require imposing 40% tariffs on almost all $2 trillion imports. The American dream of total national debt elimination thus seems remote.

In the alternative positive light, it is still plausible for the Trump administration to attain fiscal neutrality in the medium term. If the Trump administration successfully boosts 2.5% real GDP economic growth to 3% or above by 2020, the annual U.S. fiscal revenue may increase from $4.5 trillion to $5.4 trillion. The additional $900 billion fiscal intake can then offset the current U.S. budget deficit. In other words, these pro forma calculations suggest that whether Trump can keep his promise to retire national debt depends on medium-term real GDP economic revival.

Overall, 3%+ real GDP economic growth determines whether President Trump can fulfill his economic MAGA mantra.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2017-11-19 08:37:00 Sunday ET

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provisio

2020-11-24 09:30:00 Tuesday ET

Many analytic business competitors can apply smart data science to support their distinctive capabilities and strategic advantages. Thomas Davenport and

2017-12-19 09:39:00 Tuesday ET

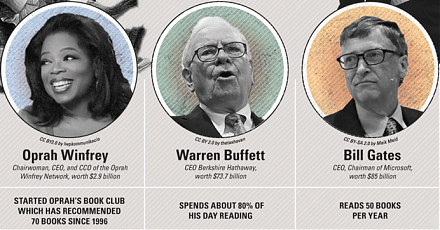

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2018-08-31 08:42:00 Friday ET

We share several famous inspirational stock market quotes by Warren Buffett, Peter Lynch, Benjamin Graham, Ben Franklin, Philip Fisher, and Michael Jensen.

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano