2019-02-25 12:41:00 Mon ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Chicago financial economist Raghuram Rajan views communities as the third pillar of liberal democracy in addition to open markets and states. Rajan suggests that communities serve as an indispensable part of a healthy economic society in stark contrast to a key source of market frictions (which may inhibit the smooth operation of the global economy). In recent times, both Brexit and the electoral successes of Donald Trump have shaken the dismal science. Prominent economists begin to consider what can constitute an efficient response to regional economic inequality. For instance, Lawrence Summers and his co-authors empirically demonstrate that both employment subsidies and tax credits should target U.S. regions with more elastic labor participation.

As open markets and states interact with socioeconomic webs of human relations, values, and norms, technological phase shifts tend to rip markets out of those old webs with populist backlashes through human history. Socioeconomic interactions eventually gravitate toward a new equilibrium with a messy and arduous transition. When markets and states scale up, political clout and economic power concentrate in vibrant hubs that prosper to the detriment of peripheral communities. Democracy preserves market competition, and open market competition preserves democracy. Rajan proposes strengthening communities as an antidote to new socioeconomic challenges.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-07-21 13:35:00 Saturday ET

President Trump supports a bipartisan bill or the Foreign Investment Risk Review Modernization Act (FIRRMA), which effectively broadens the jurisdiction of

2023-11-14 08:24:00 Tuesday ET

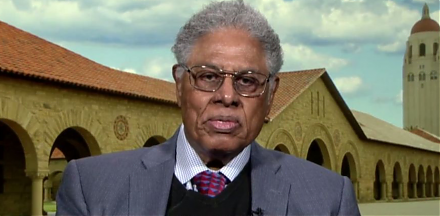

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2020-11-01 11:21:00 Sunday ET

Artificial intelligence continues to push boundaries for several tech titans to sustain their central disruptive innovations, competitive moats, and first-m

2023-03-28 11:30:00 Tuesday ET

The Federal Reserve System conducts monetary policy decisions, interest rate adjustments, and inter-bank payment operations. Peter Conti-Brown (2017)

2020-08-05 08:33:00 Wednesday ET

Business leaders often think from a systemic perspective, share bold visions, build great teams, and learn new business models. Peter Senge (2006) &nb

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an