2019-07-29 11:33:00 Mon ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an interview with Ritholtz Wealth Management, fundamental factor investors seek to manage macroeconomic risk to enhance their average returns. Ang focuses on 5 primary factors: size, value, momentum, low volatility, and high quality of profit margins. In addition, Ang oversees a broad basket of assets such as stocks, bonds, currencies, and commodities.

The consistent application of both big data and technology helps scale total assets under management with lower transaction costs. At BlackRock, Ang decomposes his favorite fundamental factors across macro and style factors. The 3 major macro factors are *economic growth, inflation, and the real interest rate*, in accordance with the baseline Taylor interest rate that depicts a highly non-linear Phillips curve. Ang empirically finds that these 3 macroeconomic factors account for 85% of stock market returns. Stock portfolio analysis helps achieve higher average returns (after risk and fee adjustments) when the active fund manager focuses on size, value, momentum, low volatility, and corporate profitability. Moreover, value occasionally becomes more cost-effective relative to its own history, and key momentum returns often cluster together in specific time periods. This factor investment methodology accords with our proprietary alpha investment model that relies on 6 fundamental factors (size, value, momentum, asset growth, operating profitability, and market risk exposure).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-09-11 10:22:00 Friday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools. In recent times, we have completed our fresh website up

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new

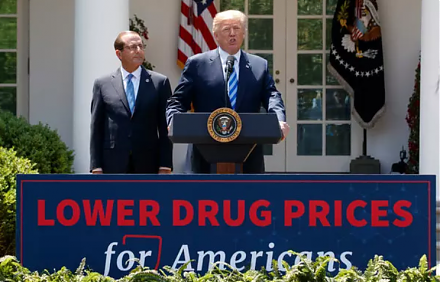

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2019-06-21 13:33:00 Friday ET

Amazon and Google face more intense antitrust scrutiny. In recent times, Justice Department and Federal Trade Commission have reached an internal agreement

2019-09-21 09:25:00 Saturday ET

President Trump praises great unity and progress at the G7 summit with respect to Sino-U.S. trade conflict resolution, global climate change, containment fo

2019-12-13 09:32:00 Friday ET

Saudi Aramco aims to initiate its fresh IPO in December 2019. Several investment banks indicate to the Saudi government that most investors may value the mi