Search results : private benefits of control

2022-04-25 10:34:00 Monday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2018-03-15 07:41:00 Thursday ET

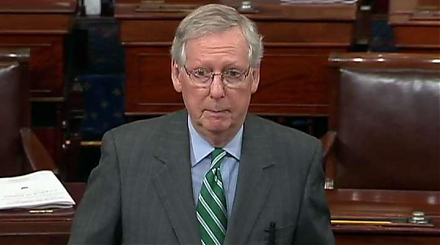

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike

2023-03-21 11:28:00 Tuesday ET

Barry Eichengreen compares the Great Depression of the 1930s and the Great Recession as historical episodes of economic woes. Barry Eichengreen (2016)

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat

2020-06-10 10:35:00 Wednesday ET

Most lean enterprises should facilitate the dual transformation of both core assets with fresh cash flows and new growth options. Scott Anthony, Clark Gi

2019-06-05 10:34:00 Wednesday ET

Fed Chair Jay Powell suggests that the recent surge in U.S. business debt poses moderate risks to the economy. Many corporate treasuries now carry about 40%