Waste Management Inc. is a leading provider of comprehensive waste management services in North America. The company provides collection, transfer, recycling and resource recovery, as well as disposal services to residential, commercial, industrial and municipal customers. It is also a leading developer, operator and owner of waste-to-energy and landfill gas-to-energy facilities in the United States. Waste Management provides collection services that include picking up and transporting waste and recyclable materials from the point of generation to a transfer station, disposal site or material recovery facility (MRF). The company owns, develops, and operates landfill gas-to-energy facilities in the United States. It owns and operates transfer stations. Waste Management also provides materials processing, commodities recycling and recycling brokerage services....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-11-17 14:43:00 Sunday ET

New computer algorithms and passive mutual fund managers run the stock market. Morningstar suggests that the total dollar amount of passive equity assets re

2019-03-07 12:39:00 Thursday ET

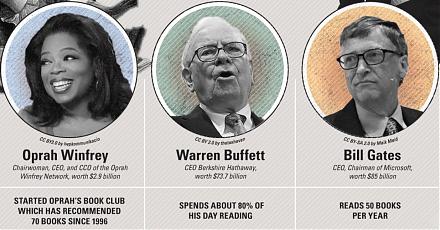

A physicist derives a mathematical formula that success equates the product of both personal quality and the potential value of a random idea. As a Northeas

2018-01-25 08:32:00 Thursday ET

After its flagship iPhone X launch, Apple reports its highest quarterly sales revenue over $80 billion in the tech titan's 41-year history. Apple expect

2025-10-02 12:31:00 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2021-02-02 14:24:00 Tuesday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement