United Technologies Corporation provides technology products and services to the building systems and aerospace industries worldwide. It offers passenger and freight elevators, escalators, and moving walkways; modernization products to upgrade elevators and escalators; and maintenance and repair services. The company also provides building systems, including cooling, heating, ventilation, refrigeration, fire, flame, gas, smoke detection, portable fire extinguishers, fire suppression, intruder alarms, access control systems, video surveillance, and building control systems; and building services, such as audit, design, installation, system integration, repair, maintenance, and monitoring. In addition, it supplies aircraft engines for commercial, military, business jet, and general aviation markets; and provides aftermarket maintenance, repair, and overhaul, as well as fleet management services. Additionally, the company offers electric power generation, power management, and distribution systems; air data and aircraft sensing systems; engine control, intelligence, surveillance, and reconnaissance systems; engine components; environmental control systems; fire and ice detection, and protection systems; propeller systems; engine nacelle systems; aircraft lighting, seating, and cargo systems; actuation and landing systems; space products and subsystems; avionics systems; precision targeting; electronic warfare and range systems; flight controls, communications, navigation, oxygen, and simulation and training systems; food and beverage preparation, and storage and galley systems; and lavatory and wastewater management systems. It provides its services through sales representatives, building contractors and owners, transportation companies and retail stores, and through joint ventures, independent sales representatives, distributors, wholesalers, and dealers. United Technologies Corporation was incorporated in 1934 and is headquartered in Farmington, Connecticut....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-06-06 09:39:00 Wednesday ET

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bila

2019-09-01 10:31:00 Sunday ET

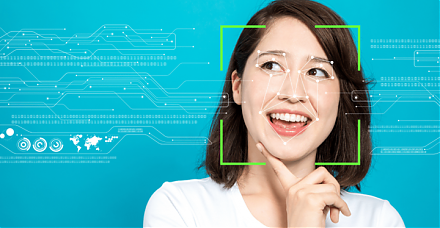

Most artificial intelligence applications cannot figure out the intricate nuances of natural language and facial recognition. These intricate nuances repres

2025-09-14 14:23:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2019-10-19 16:35:00 Saturday ET

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and

2019-12-28 09:36:00 Saturday ET

Global debt surges to $250 trillion in the fiscal year 2019. The International Institute of Finance analytic report shows that both China and the U.S. accou