Mettler-Toledo International Inc. is the world's largest manufacturer and marketer of weighing instruments for use in laboratory, industrial and food retailing applications. The company focuses on the high value-added segments of the weighing instruments market by providing solutions for specific applications. Mettler-Toledo is also a leading provider of analytical instruments for use in life science, reaction engineering and real-time analytic systems used in drug and chemical compound development, and process analytics instruments used for in-line measurement in production processes. The company has three reportable segments: Laboratory Instruments, Industrial Instruments and Retail Weighing Solutions....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-02-25 06:44:00 Saturday ET

As the White House economic director, Gary Cohn suggests that the Trump administration will tackle tax cuts after the administration *repeals and replaces*

2019-09-23 12:25:00 Monday ET

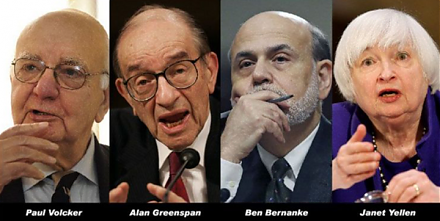

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2019-02-03 13:39:00 Sunday ET

It can be practical for the U.S. to impose the 2% wealth tax on the rich. Democratic Senator Elizabeth Warren proposes a 2% wealth tax on the richest Americ

2019-01-01 03:34:48 Tuesday ET

American allies assist AT&T and Verizon in implementing 5G telecommunication technology in the U.S. as such allies ban the use of HuaWei 5G telecom equi

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

2017-12-23 10:40:00 Saturday ET

Despite having way more responsibility than anyone else, top business titans such as Warren Buffett, Charlie Munger, and Oprah Winfrey often step away from