Microsoft Corporation is one of the largest broad-based technology providers in the world. The company dominates the PC software market with more than 80% of the market share for operating systems. The company's Microsoft 365 application suite is one of the most popular productivity software globally. It is also now one of the two public cloud providers that can deliver a wide variety of infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) solutions at scale. Microsoft's products include operating systems, cross-device productivity applications, server applications, business solution applications, desktop and server management tools, software development tools and video games. The company designs and sells PCs, tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories. Through Azure, it offers cloud-based solutions that provide customers with software, services, platforms and content....

+See MoreSharpe-Lintner-Black CAPM alpha (2.66%) Fama-French (1993) 3-factor alpha (3.55%) Fama-French-Carhart 4-factor alpha (4.33%) Fama-French (2015) 5-factor alpha (5.14%) Fama-French-Carhart 6-factor alpha (5.91%) Dynamic conditional 6-factor alpha (11.59%) Last update: Saturday 7 March 2026

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod

2018-04-13 14:42:00 Friday ET

Mike Pompeo switches his critical role from CIA Director to State Secretary in a secret visit to North Korea with no regime change as the North Korean dicta

2019-11-11 09:36:00 Monday ET

Apple upstream semiconductor chipmaker TSMC boosts capital expenditures to $15 billion with almost 10% revenue growth by December 2019. Due to high global d

2025-04-30 08:27:00 Wednesday ET

The multiple layers of the world cloud Internet help expand what can be made digitally viable from electric vehicles (EV) and virtual reality (VR) headsets

2019-05-03 11:29:00 Friday ET

Key tech unicorns blitzscale business niches for better scale economies from Uber and Lyft to Pinterest, Slack, and Zoom. LinkedIn cofounder and serial entr

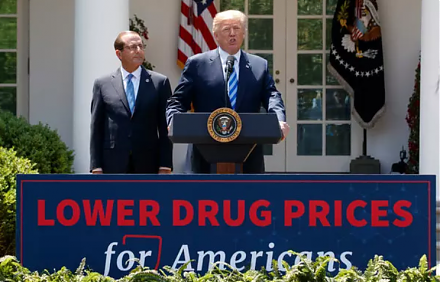

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri