First United Corporation is a one-bank holding company with two non-bank subsidiaries....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-12-19 09:39:00 Tuesday ET

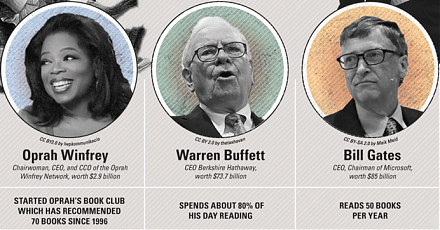

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2017-04-01 06:40:00 Saturday ET

With the current interest rate hike, large banks and insurance companies are likely to benefit from higher equity risk premiums and interest rate spreads.

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M

2022-03-15 10:32:00 Tuesday ET

Capital structure theory and practice The genesis of modern capital structure theory traces back to the seminal work of Modigliani and Miller (1958

2020-02-02 11:32:00 Sunday ET

Our fintech finbuzz analytic report shines fresh light on the current global economic outlook. As of Winter-Spring 2020, the analytical report delves into t

2019-01-21 10:37:00 Monday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube January 2019 In this podcast, we discuss several topical issues