Ameresco, Inc. is an independent provider of comprehensive energy efficiency solutions for facilities throughout North America. The Company's solutions include upgrades to a facility's energy infrastructure, and the construction and operation of renewable energy plants. It engages in the development, design, engineering, and installation of projects that reduce the energy, as well as operation and maintenance costs of governmental, educational, utility, healthcare, and other institutional, commercial, and industrial entities facilities. Ameresco, Inc. is headquartered in Framingham, Massachusetts....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-02-05 10:32:00 Tuesday ET

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s

2017-06-21 05:36:00 Wednesday ET

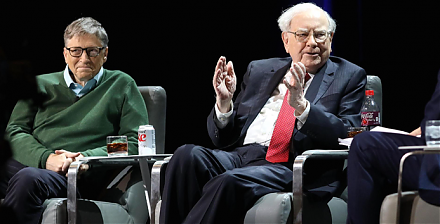

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2017-11-03 06:41:00 Friday ET

Broadcom, a one-time division of Hewlett-Packard and now a semiconductor maker whose chips help power iPhone X, has announced its strategic plans to move it

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no

2019-03-19 12:35:00 Tuesday ET

U.S. tech titans increasingly hire PhD economists to help solve business problems. These key tech titans include Facebook, Amazon, Microsoft, Google, Apple,

2017-08-31 09:36:00 Thursday ET

The Trump administration has initiated a new investigation into China's abuse of American intellectual property under Section 301 of the Trade Act of 19