Alta Mesa Resources, Inc., formerly Silver Run Acquisition Corporation II, incorporated on November 26, 2016, is an oil and gas exploration company. The Company is focused on the development and acquisition of unconventional oil and gas reserves in Oklahoma. Its exploration operations are located in the eastern portion of the Anadarko basin, and are referred to as Sooner Trend Anadarko Basin Canadian and Kingfisher County (STACK). ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-03-13 12:35:00 Wednesday ET

Uber seeks an IPO in close competition with its rideshare rival Lyft and other tech firms such as Slack, Pinterest, and Palantir. Uber expects to complete o

2019-04-15 08:37:00 Monday ET

Chinese Belt-and-Road funds large international infrastructure investment projects primarily in East Asia, Central Asia, North Africa, and Italy. Chinese Be

2019-05-30 16:44:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube May 2019 In this podcast, we discuss several topical issues as of May 2019: (1) Our proprietary alp

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

2019-03-27 11:28:00 Wednesday ET

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2017-04-07 15:34:00 Friday ET

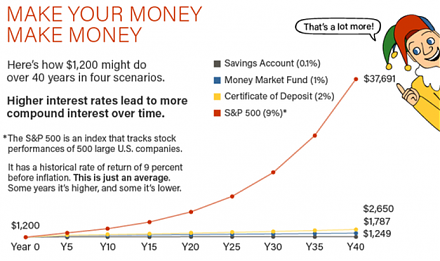

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive