Apple's business primarily runs around its flagship iPhone. However, the Services portfolio that includes cloud services, App store, Apple Music, AppleCare, Apple Pay & licensing and other services which become the cash cow. Moreover, non-iPhone devices like Apple Watch and AirPod have gained significant traction. In fact, Apple dominates the Wearables and Hearables markets due to the growing adoption of Watch and AirPods. Solid uptake of Apple Watch also helps Apple to strengthen its presence in the personal health monitoring space. Apple also designs, manufactures and sells iPad, MacBookand HomePod. These devices are powered by software applications including iOS, macOS, watchOS and tvOS operating systems. Apple's other services include subscription-based Apple News, Apple Card, Apple Arcade, new Apple TV app, Apple TV channels and Apple TV, a new subscription service....

+See MoreSharpe-Lintner-Black CAPM alpha (2.30%) Fama-French (1993) 3-factor alpha (3.27%) Fama-French-Carhart 4-factor alpha (4.07%) Fama-French (2015) 5-factor alpha (4.93%) Fama-French-Carhart 6-factor alpha (5.71%) Dynamic conditional 6-factor alpha (11.28%) Last update: Saturday 7 March 2026

2018-11-29 11:33:00 Thursday ET

A congressional division between Democrats and Republicans can cause ripple effects on Trump economic reforms. As Democrats have successfully flipped the Ho

2019-10-21 10:35:00 Monday ET

American state attorneys general begin bipartisan antitrust investigations into the market power and corporate behavior of central tech titans such as Apple

2018-01-23 06:38:00 Tuesday ET

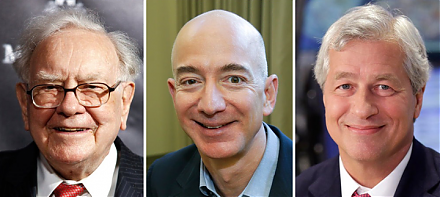

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-07-15 11:35:00 Sunday ET

Facebook, Google, and Twitter attend a U.S. House testimony on whether these social media titans filter web content for political reasons. These network pla

2017-05-19 09:39:00 Friday ET

FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon. These tech giants account for more than 15% of market capitalization of the American stock

2023-07-28 11:28:00 Friday ET

Lucian Bebchuk and Jesse Fried critique that executive pay often cannot help explain the stock return and operational performance of most U.S. public corpor